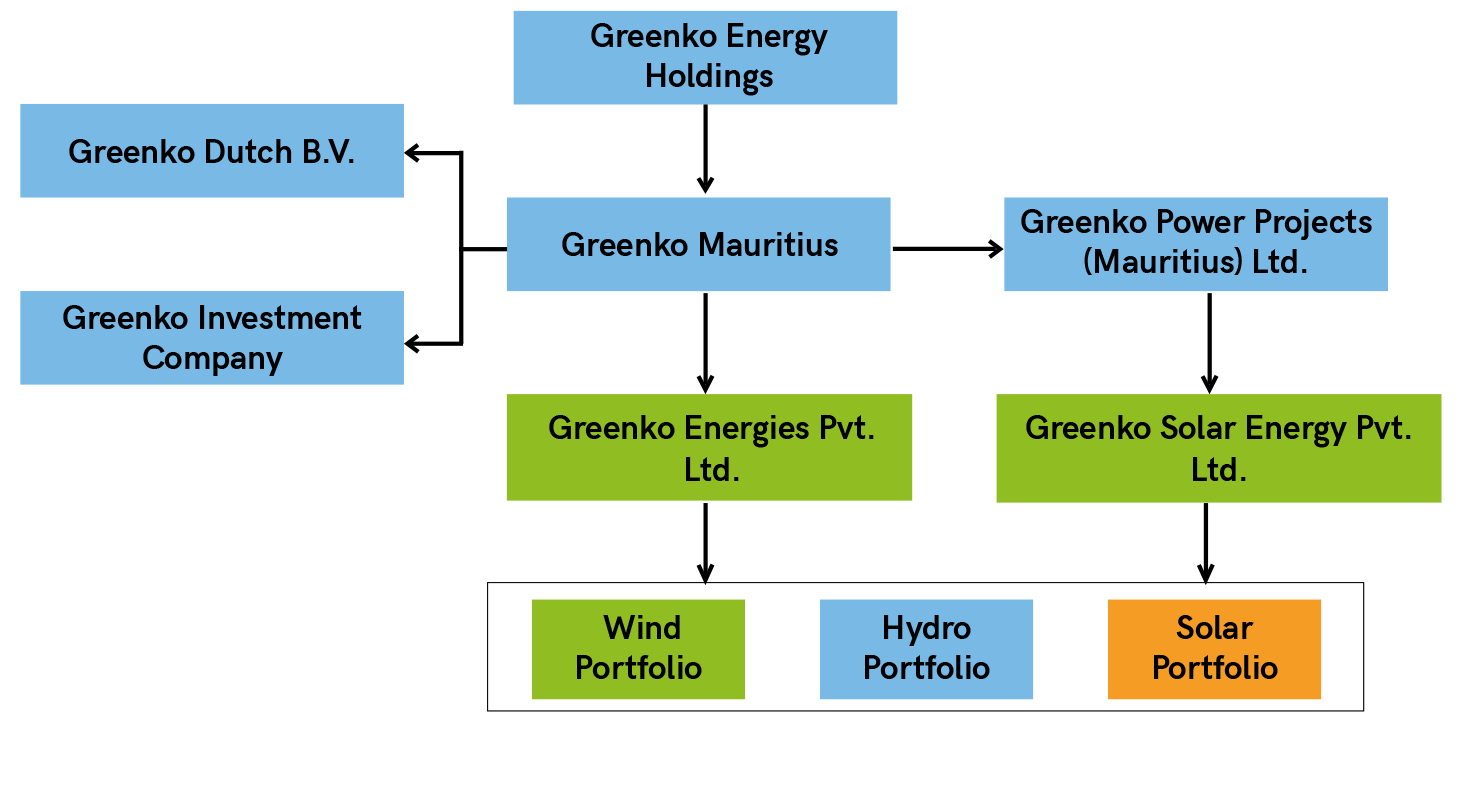

Greenko Energy Holdings together with its subsidiaries (“Greenko Group”) is in the business of owning and operating clean energy facilities in India. All the energy generated from these plants is sold to state utilities and other customers including captive consumers through power purchase agreements (“PPA”).

The board periodically reviews strategy and guides the company to protect and enhance its value creation abilities in the face of evolving global and regional developments.

The governance framework sets rules, processes and practices that balance the interests of a company’s many stakeholders, such as shareholders, management, customers, suppliers, financiers, government and the community. The governance processes encompass practically every sphere of management, from action plans and internal controls to performance measurement and corporate disclosure.

Our governance framework, established by our stakeholders, is based on the following principles and practices:

Long term success and financial and non financial sustainability

Diverse composition reflecting the scale and complexity of the business

Structured timely meetings and appropriate information-flow

Risk management and control

Clear division of responsibilities within the board and the management

Board duties managed and supervised by the Board committees

Structured appraisal system in the Board for each individual director

Greenko Board takes its stakeholders very seriously. Suitable programs and events are established for the stakeholders

In addition to its primary role of monitoring corporate performance, the functions of the Board include:

Reviewing and approving potential acquisitions

Reviewing and approving major capital expenditure items

Reviewing and approving financing matters

Monitoring the Parent Guarantor’s exposure to key business risks

Reviewing the strategic direction

Reviewing and approving the annual budgets as well as the progress against those budgets and;

Generally, steering the management of the business