Going forward, Greenko would harness patient and responsible capital to actualise the possibility of clean, relaible and affordable energy in India.

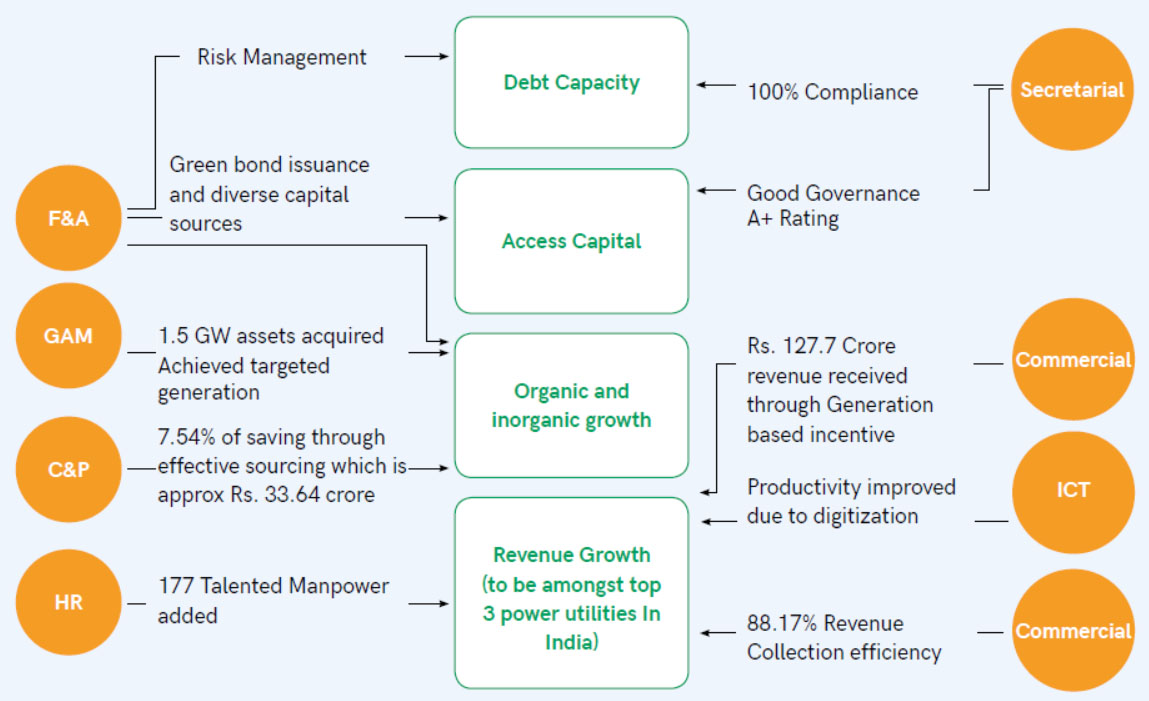

Availability of financial capital at right cost and time is critical in the pursuit of Greenko’s vision and mission. Every function and business understands the concerns and expectations of capital providers. Greenko’s diligent evaluation and assessment of opportunities, partnerships and acquisitions; and risk identification, control and provisioning for residual risk illustrate our strategic approach to reinforce financial capital

Greenko would build upon stakeholder trust to pursue opportunities in the energy sector in India and make it possible to generate clean, reliable and affordable power. Besides, clean and schedulable electricity will be the new energy as the demand for oil and gas in India will flatten off much earlier to 2035. Greenko believes that investors across the globe would harness the opportunity to address deep decarbonisation and digitalisation of energy sector in India. Greenko would continue to (i) tap these diverse sources of responsible and patient capital and (ii) strengthen governance including risk management at all levels