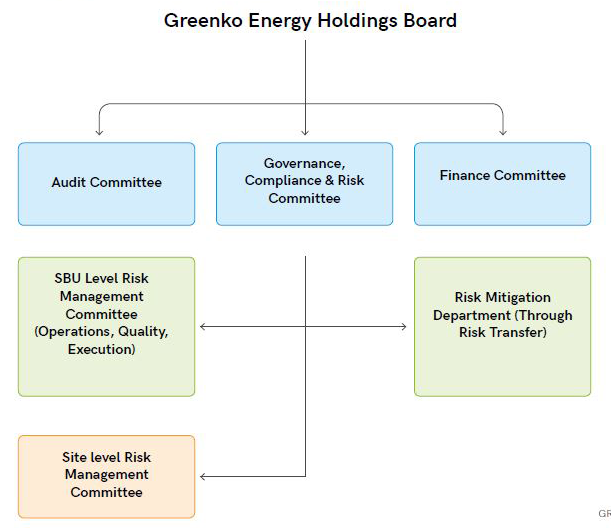

The terms of reference of the Audit and Risk Committee include the following:

Overseeing and planning all audit activities and the definition of the scope of those activities;

Monitoring the integrity of the financial statements and any announcement or communications relating to financial performance;

Reviewing internal financial controls, reviewing the Company’s internal control and risk management systems;

Reviewing internal risk assessment reports and the evaluation of actions intended to mitigate identified risks;

Monitoring and reviewing the effectiveness of the internal audit function;

Making recommendations to the Company’s Board of Directors in relation to the appointment, re-appointment and removal of the external auditor and approving the remuneration and terms of engagement of the auditor; and

Reviewing the auditor’s independence and objectivity.

The Audit and Risk Committee is required to meet at least three times in a year, including once before the finalization of annual accounts and once every six months.

The Remuneration Committee and Nomination determine Greenko’s remuneration policy, in regard to performance standards and existing industry practice. Under the existing policies of the Company, the Remuneration and Nomination Committee determines, inter alia, the remuneration and benefits package payable to the Directors.

Apart from discharging the above-mentioned functions, the Remuneration and Nomination Committee also discharges the following functions:

Setting up the remuneration policy for all executive directors and the Company’s chairman, including pension rights and any compensation payments;

Recommending the level and structure of remuneration for senior management;

Recommending appointments to the Board of Directors of the Company’s subsidiaries;

Within the terms of the remuneration policy and in consultation with the directors, determining the total individual remuneration package of each designated senior executive including bonuses, incentive payments and share options or other awards;

Reviewing and designing incentive plans for approval by the Board of Directors and shareholders;

Assessing and approving the performance or nonperformance of targets set for awarding incentives exercises;

Determining the policy for, and scope of, pension arrangements for each executive director and other designated senior executives;

overseeing the hiring of key executives and members of the Board of Directors;

Ensuring that contractual terms of termination, and any payments made, are fair to the individual and the Company;

Planning and preparing for Board succession and development; and

Considering any other matter that may be referred by the Board of Directors for consideration by the Committee from time to time in respect of employment, remuneration