|

Mega Forces Shaping New Energy System |

Electricity is the fastest-growing source of final energy demand, and over the next 25 years. The global electricity supply is also being transformed by the rise of variable renewable sources of generation such as wind and solar PV. This positions electricity at the forefront of the clean-energy transitions, providing access to the nearly 1 billion people currently deprived, helping cut air pollution and meet climate goals. However, this transition will require a new approach to how power systems are designed and how they operate. Otherwise, rising electrification could result in less secure energy systems, underscoring the urgent need for policy action in this critical sector.

Electricity today accounts for 19% of total final consumption of energy and the share is expected to reach in the business-as-usual scenario to 24% in 2040, very much behind full electrification. Also, not all enduses can be readily electrified, such as high-temperature heat demand in industry, long-haul aviation and shipping, where electrification is harder to achieve due to either economic or technical barriers. Developing economies will account for much of electrification, as the largest share of new demand, driven by rapid economic and population growth, and increasing policy push towards electrification. Accelerating use of electric vehicles could see demand growth in developing economies increase even more rapidly.

A strong push to electrification which is nothing more than push for electric mobility which is already happening in India, could result in oil demand declining post 2030 and electricity expenditure overtaking oil & gas before 2035.

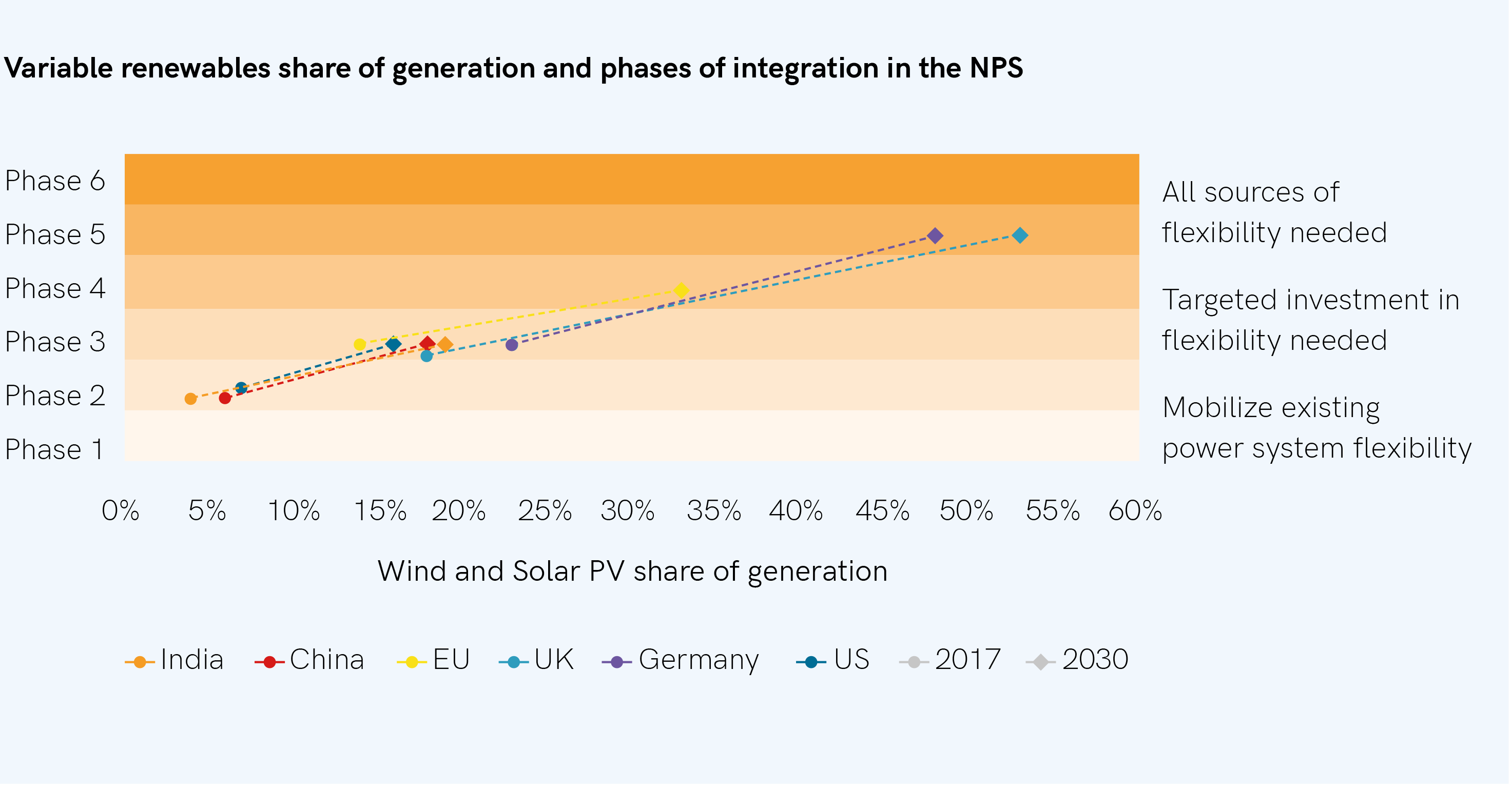

Electrification alone is not sufficient to meet climate goals; this would require a more comprehensive energy system strategy. Much more widespread deployment of renewables combined with storage can help follow a more sustainable trajectory. Due to falling prices and encouraging government policies, solar PV capacity is surging to overtake wind by 2025 and coal in the mid- 2030s to become the second-largest installed capacity globally, after gas. Gas-fired capacity could overtake coal well before 2030, as countries shift away from coal to address GHG emissions and air pollution concerns. However, to address the flexibility and reliability of electricity supply, much of coal could be replaced by renewables and not the gas in countries like India due to challenges of availability and landed cost of gas only if pumped and other storage options are harnessed. Decarbonization in some geographies may become deeper decarbonization making the progress towards 1.5 degrees goal achievable. Connecting it all Building flexible power systems to accommodate the transition to low-carbon electrical systems of the future will be critical to ensure reliability. Government policies will consider flexibility as a core component of electricity system design and management. Flexibility needs are set to increase due to the transforming nature of electricity demand and supply; driven by electrification of mobility and the changes in the way electricity is used on a daily basis. The rising shares of wind and solar PV increase the need for system flexibility improvement interventions to manage the variability of their output.

System flexibility needs of a country depend not only on the share of variable renewables in an annual generation, but also is influenced by existing flexibility resources and the match between solar PV, wind and demand profiles. In the near future, as countries experience increased demand for flexibility beyond power plants and transmission interconnections, they would adopt demand-side response and energy storage technologies, including battery storage.

Power sector investment needs to address flexibility to ensure electricity security. Government policy will play an integral role in all markets.

The shift to distributed energy systems is opening up opportunities for merchant and retail power, flexible generation and technology-enabled business models.

As industries change and the distribution of power consumption trends towards a growing number of smaller economic hubs, there is less need for large central power stations. In their place, expect to see an increase in smallscale generation. A society and economy that depends on electricity supplied by a highly complex, digitalized set of decentralized energy systems opens itself up to potentially serious issues, such as cybecrime or systemic failure. A small-scale, decentralized generation depends on a robust and reliable grid to provide flexible power without blackouts. A smart grid complete with energy storage to capture excess power for periods of high demand and interconnectors to facilitate trading will be required to match supply to demand at all times. This challenge can be addressed through advances in digitalization and Intelligent Energy Platform.

In the future, India is set to contribute more than any other country to the projected rise in global energy demand, around one-quarter of the total. Urbanization will be a key diver of this trend as an additional 315 million people are expected to live in India’s cities by 2040. This will push up the demand from energy-intensive sectors (IEA, India Energy Outlook, 2015)

As a part of its international commitment, India put forward eight Nationally Determined Contributions (NDCs) under the Paris Agreement of UNFCCC, India would increase the share of renewables in power generation to 22% in 2032 and capacity is 45% to 2030. As a result of this transition to clean energy, as per working paper on the subject by Niti Ayog, the Government of India, cumulative CO2 emissions from the power sector will reduce by 375Mt CO2 but total emissions, which decrease by only 5%. Also, performance on emissions intensity improves significantly—falling by 41% by 2032, relative to 2017 level and 80% compared to 2005 level as mentioned in India’s First Biennial Update Report to the United Nations Framework (GOI, First Biennial Update Report to the United Nations Framework Convention on Climate Change, 2015). However, the decline is expected to be slow, the later years in as it gets dampened due to the cumulative increase in absolute emissions. This implies that deeper decarbonization is required to slow down the growth of total CO2 emissions. Such, deeper carbonization is likely to happen with the decreasing solar panel prices, improvement of efficiencies in renewable generation technologies and digitalization. Only barrier to deeper decarbonization efforts in India is the lack of schedulability of renewable generation.

Deeper decarbonization is imperative across the globe and in India. India is committed to taking leadership in climate mitigation and also technology improvements are driving increasing share of clean components of electricity generation capacity. This will drive the new value pool in electricity generation- schedulable renewable power.

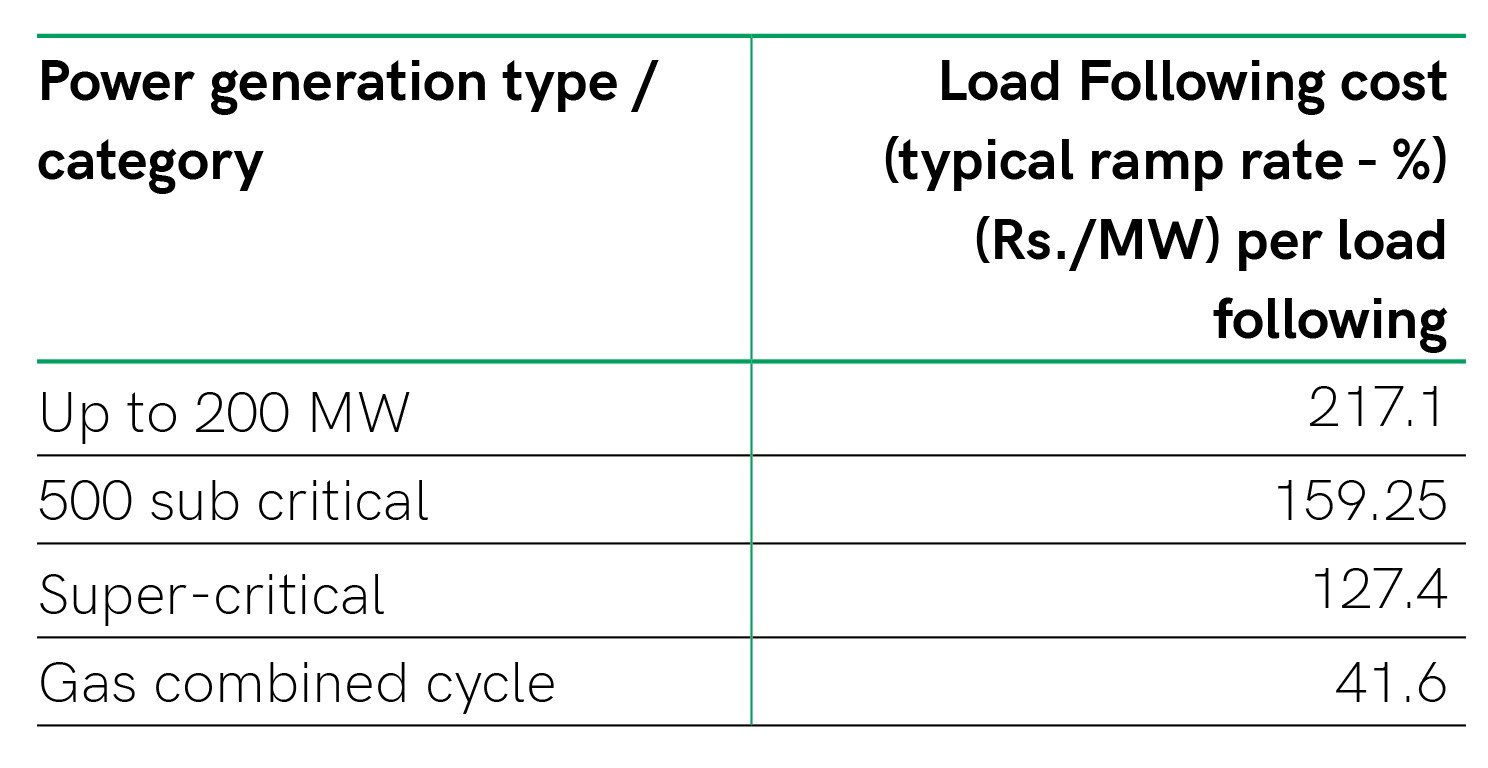

The Central Electricity Authority of GoI, recently arrived at an optimal cost electricity generation using generation expansion planning tool. Objective of this study is to optimize (i) the costs associated with operation of the existing and committed (planned and under construction) generating stations (ii) the capital cost and operating cost of new generating stations required for meeting peak electricity demand and electrical energy requirement while satisfying different constraints in the system such as:

Fuel availability constraints

Technical operational constraints viz. minimum technical load of thermal units, ramp rates, start-up and shut-down time etc.

Financial implications arising out of start-up cost, fuel transportation cost etc.

Intermittency associated with renewable energy generation.

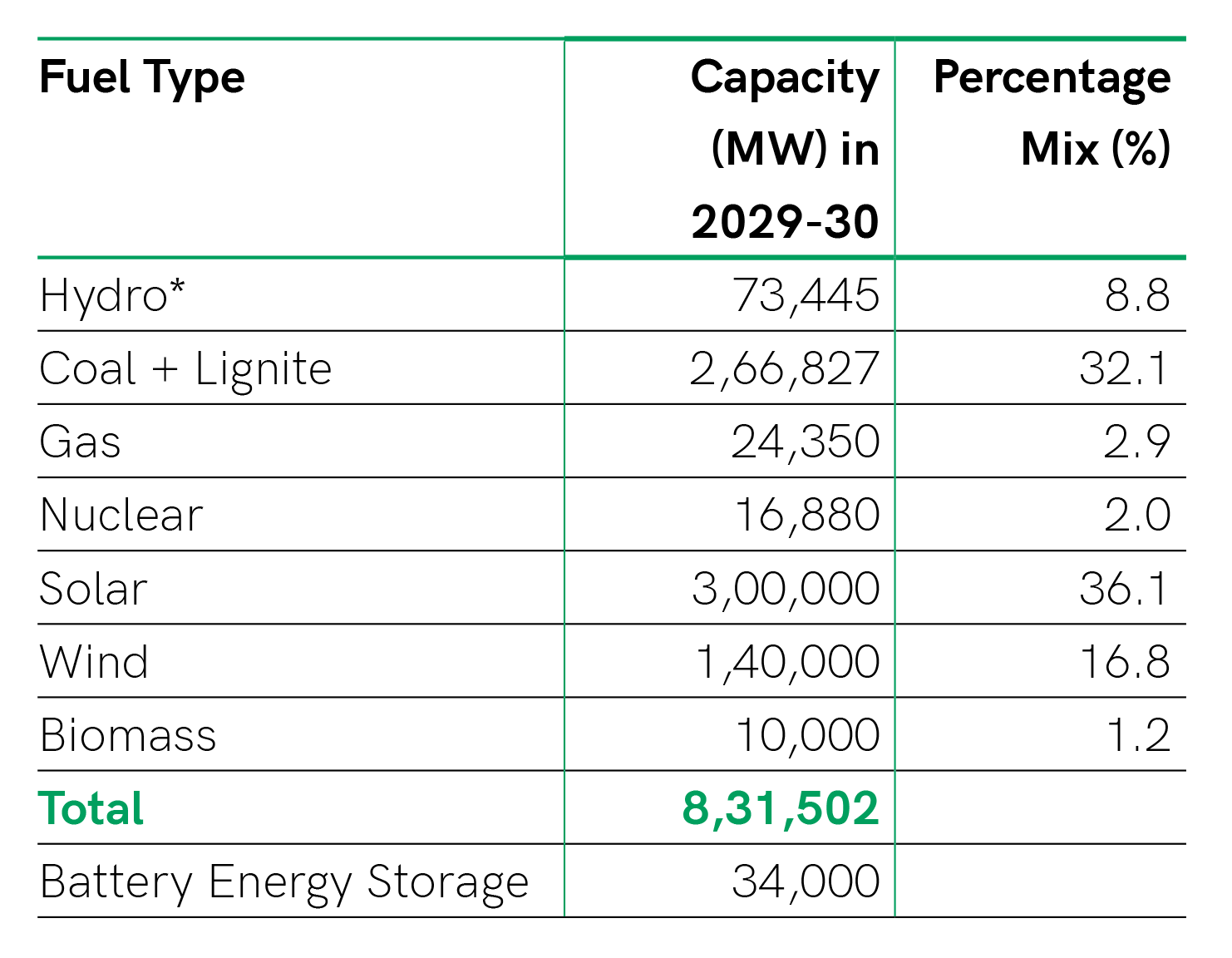

Central Electricity Authority, using this study concludes that the mix given below achieves optimal cost to the economy.

(Ref: Report of Government of India, Ministry of Power, Central Electricity Authority “Committee on Optimal Energy Mix in Power Generation on Medium and Long Term Basis 01-01-2018”, pg. 28)

The salient part in this optimal mix is 34 GW of storage requirement which is clearly due to intermittency associated with renewable energy generation. With RE technology advances and decreasing capital costs, RE generation, in the future, will be the best cost option. Further, promotion and incentives may be tuned to address schedulable renewables.

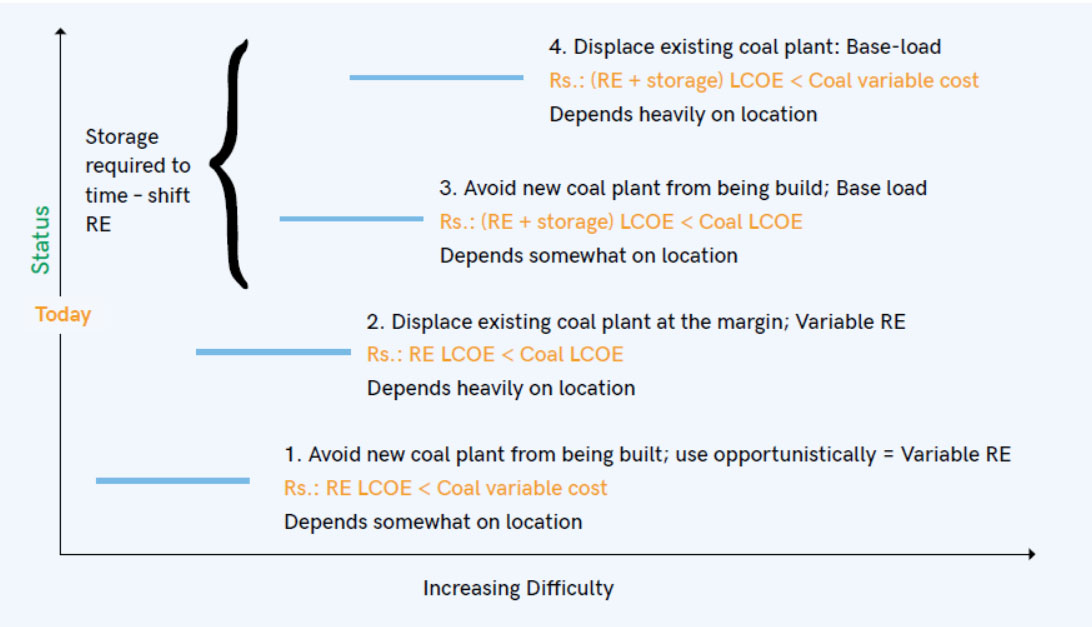

Also, the ladder of competitiveness of renewables vs coal in India requires that renewables have to be schedulable for deep carbonization.

Also, demand for electricity in India will be significant in many urban centers as additional 315 million people are to join the urban cities by 2030. The industry and transportation within these centers are being envisaged to operate with clean, reliable and affordable power. Already, many businesses in India are contemplating near 50% renewable electricity by 2030 and 100% by 2050, keeping with RE 100 and CDP movement. This is another significant driver for schedulable renewable power generation.