The business operations of Greenko Energy Holdings and its

subsidiaries (Greenko Group) revolve around owning and operating

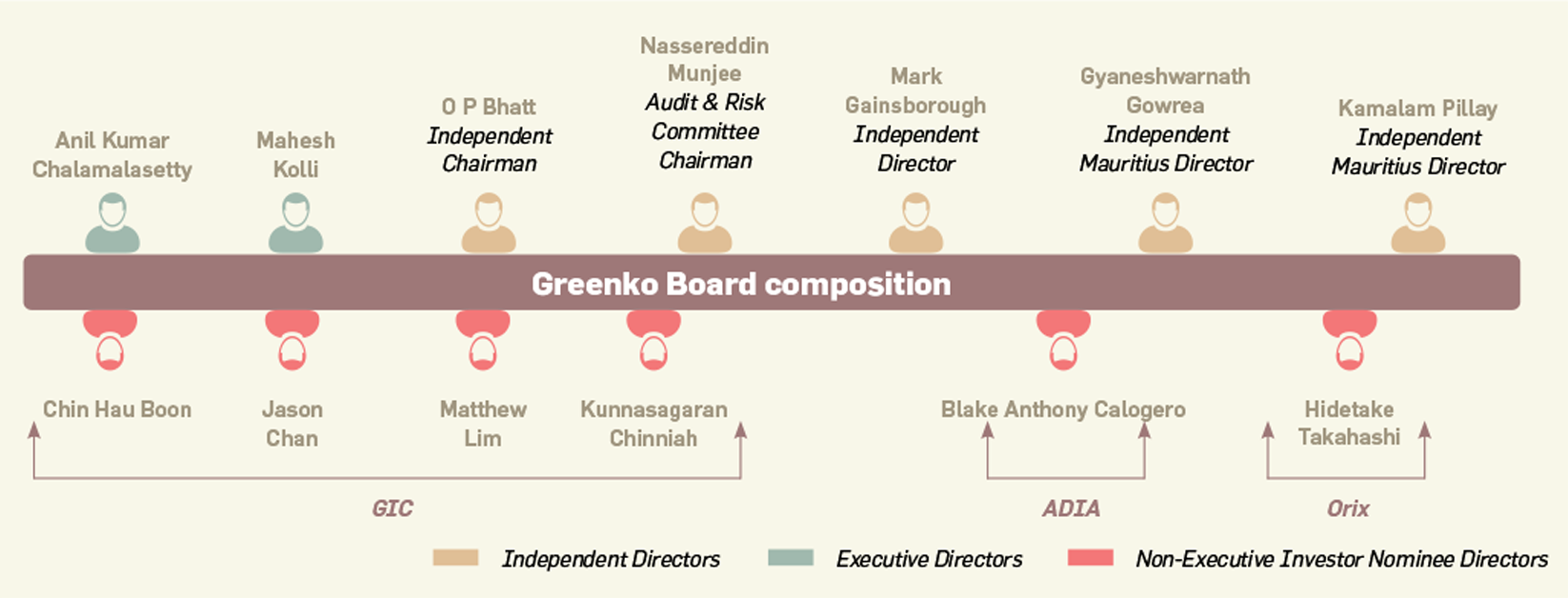

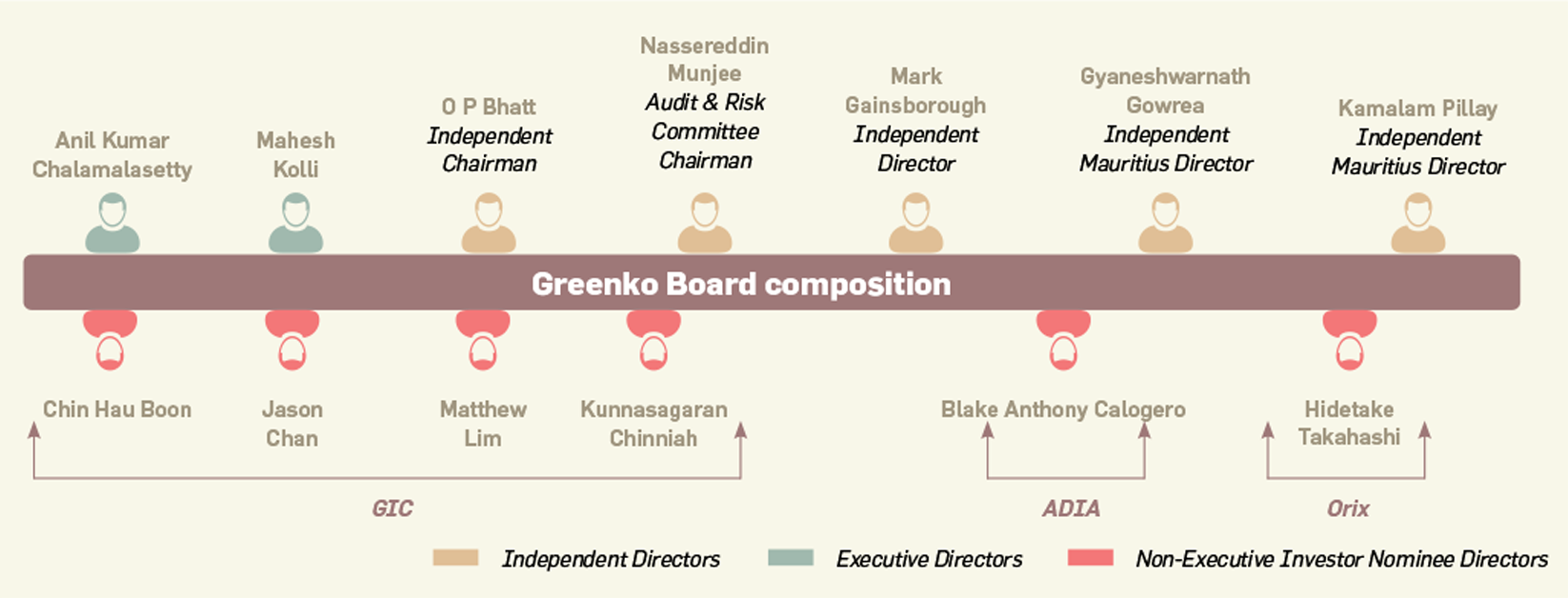

clean energy technologies in India. The board is constituted by

various representatives from GIC, ADIA, ORIX Founders and

independent directors.

Shareholder Pattern 2

Our

major

stakeholders

GIC,

Sovereign

Wealth

fund of Government

of Singapore and Abu

Dhabi

Investment

Authority

(ADIA),

Sovereign

Wealth

fund of Government

of Abu Dhabi , ORIX

Corporation

and

Greenko

Vetures

Limited.

Greenko has well drafted set of

principles, policies, structures leading

to a strong and resilient corporate

governance framework, that serve

as a nucleus for carrying out the

company’s business operations to

meet

financial,

operational,

and

strategic objectives and also defines

a mutual relationship between its

shareholders, stakeholders and the

Board. By adhering 100% to the

framework, Greenko continues to

enjoy enhanced stakeholder trust year

on year and emerges to be a strong,

viable, competitive and accountable

corporation.

The

governance

framework is crafted considering

- The nature of the business

- The company’s size and stage of development

- Availability of resources

- Shareholder’s expectations and

- Legal and regulatory requirements

The Governance Framework at

Greenko is constructed on the

following principles:

Ethical approach – culture, society;

organizational paradigm

Balanced objectives – congruence

of goals of all interested parties

Each party plays its part – roles

of

key

players:

shareholders/

directors/ staff

Decision-making process in place –

reflecting the first three principles

and giving due weight to all

stakeholders

Equal concern for all stakeholders

– albeit some have greater weight

than others

Accountability and transparency –

for all stakeholders

The salient features of Greenko’s

Corporate Governance Framework are

as follows

Steering for the Long-Term 3

Greenko’s Vision and Mission are well

aligned with the shareholder interests

for accomplishing long term goals. To

continue the focus on decarbonization,

digitalization,

and

decentralization

of the Energy System in India and

harness all the value pools, Greenko

cannot afford to be immobilized by

the demands of quarterly results and

focuses always on long-term goals,

such as market share targets, percent

of revenue from new markets, besides

quarterly earnings guidance. Greenko

follows a staggered representation

of the Board and this ensures in

promoting continuity and stability

across the boardroom.

Best in the Board

Greenko’s Board ensures that its

membership has the proper mix of skills

and perspectives. To reaffirm this, the

Board not only follows age term limits

but also maintains gender and other

diversity requirements. The Board

critically reviews their composition

and appropriate skill sets to promote

ambitious growth of the company.

The Board presently conducts internal evaluations by the chairman or lead

director and process design for reviews

involving grading directors on various

company-specific attributes.

Orderly Voice to Shareholders

Greenko’s

executive

directors’

campaign

aims

to

provide

shareholders equal opportunity to

make decisions and make their voice

heard in a reasonable way.

At Greenko, we follow the best

corporate governance practices, as

stated below:

- The

Board

comprises

of

knowledgeable directors who are

highly qualified and competent,

having

relevant

expertise

in

business operations. They have

strong ethics and integrity, diverse

backgrounds and skillsets, and

sufficient time to commit to their

duties.

- The Board identifies regularly

the gaps in the list of directors,

complement

them

with

ideal

qualities,

characteristics

and

keeps an ‘evergreen’ list of suitable

candidates to fill Board vacancies.

- Most of the directors are non-

executive and some including the

Chairman are independent.

- An

engaged

Board

where

directors’ question and challenge

management decisions.

- Conducting

familiarization

programs covering the business,

their duties, and the Board’s

expectations; reserve time in Board

meetings for ongoing education

about the business and governance

matters.

- Review

Board

mandates

and

undertake performance evaluation.

Define roles and responsibilities

Greenko conventionally adheres to

following good governance principles:

-

Written mandates for the Board

and each committee setting out

their duties and accountabilities.

-

Delegation

of

certain

responsibilities

to

committees

such as audit, nomination, and remuneration and ‘special committees’

formed to evaluate proposed transactions

or opportunities.

-

Written position descriptions for the Board

Chair, Board committees, the CEO, and

executive officers.

-

Separation of the roles of the Board Chair

and the CEO: The Chair leads the Board

and ensures it acts in the company’s long-

term interests; the CEO leads management,

develops and implements business strategy,

and reports to the Board.

Emphasize integrity and ethical dealing

-

Adopted a conflict-of-interest policy and a

code of business conduct setting out the

company’s requirements and process to

report and deal with non-compliance and

formulated a Whistle blower policy.

-

Appointed a dedicated Director responsible

for oversight and management of these

policies and procedures.

-

Evaluate performance and make principled

compensation decisions

-

Directors’ fee structure does not conflict

with

the

director’s

independence

or

discharge of his/her duties.

-

Measurable

performance

targets

for

executive officers (including the CEO)

to regularly assess and evaluate their

performance against set standards and

align compensation to performance.

-

Establish a Compensation Committee

comprising

of

independent

directors

to

develop

and

oversee

executive

compensation plans.

Effective Risk Management

-

The Board is responsible for strategically

establishing the company’s risk tolerance

mechanism, thereby developing a framework

and clear accountabilities for managing risk.

It reviews, by itself or by anointing external

independent parties, the adequacy of the

systems and controls in place to identify,

assess, mitigate, and monitor risks and the

sufficiency of its reporting.

-

Directors are responsible for understanding

the current and emerging short and long-

term risks the company faces and its

performance implications. Management’s

assumptions are often challenged, and

the adequacy of the company’s risk

management processes and procedures

are assessed.

1(GRI 102-18, 102-19, 102-32) | 2(GRI 102-5, 102-7, 102-10) | 3(GRI 102-26)