Circular and Regenerative Approach

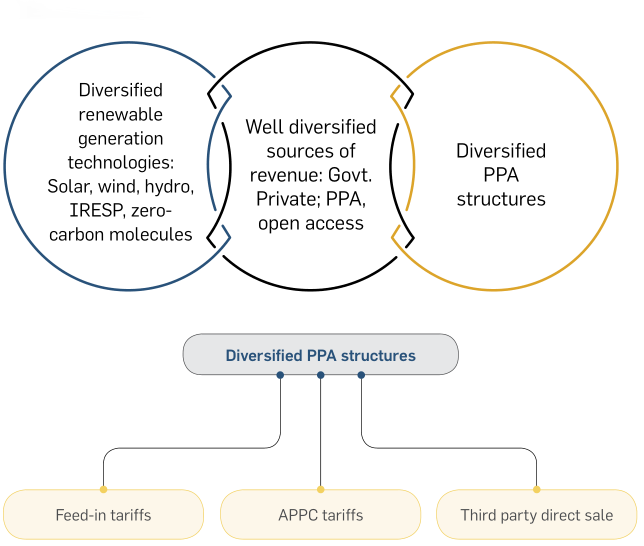

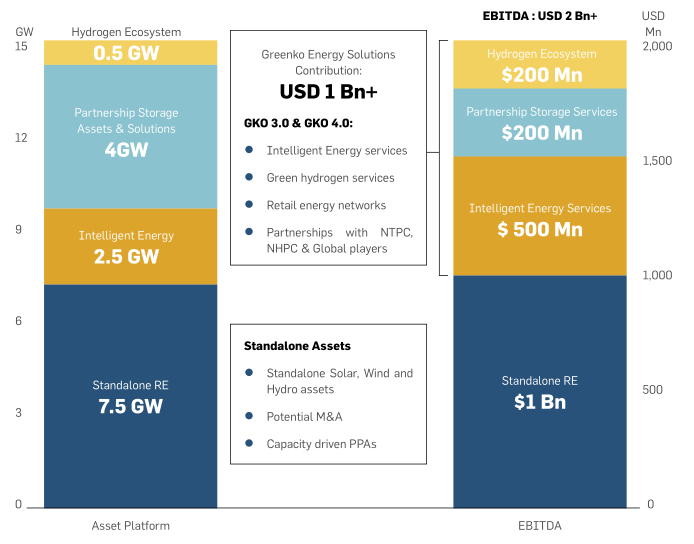

The organization aims to harness overall organic and

inorganic growth by embracing circular and regenerative

thinking as a way of business.

Greenko’s Integrated Renewable Energy

Project, which is designed to address the

inherent infirmity of wind and solar energy

by employing the innovative solutions of

Pumped Storage Plant (PSP), is an important

component of our circular approach. These

projects are designed as sharing platforms of

storage and other electricity system services.

Under

the

circularity

and

regenerative

thinking approach, Greenko aspires to explore

and employ innovative ideas and action plans,

such

as

‘invest-generate-and-Consume’,

‘harness increasing electrification’, ‘solutions

to non-electric use sectors’. - which are

adjacencies to the present business

Managing Climate Change Impacts – Risks and Opportunities

Greenko’s three pillars- Renewable Energy,

Storage and Zero Carbon Molecules are

building blocks of transition towards a low

carbon economy and to meet the target of

restricting the average global temperature

rise to 2°C and further ambition Paris Climate

Agreement to limit the global warming to 1.5

degrees, to minimize the catastrophic impacts

of climate change . However, like every other

sector, the renewable energy sector is also

susceptible to the impacts of climate change

as the entire supply chain of the renewable

energy system is significantly vulnerable to

climate variability.

Physical Climate Risks

Greenko’s assets face the physical risks of

climate change such as extreme weather

events which can range from droughts to

tropical storms. The physical risks have the

potential to directly damage the organization’s

assets and indirectly disrupt the supply chain

due to the impact on production facilities,

sales, and workforce.

The

electricity

production

potential

of

renewable energy is critically impacted by

the physical risks of climate change, due

to its dependence on climate conditions.

A shift in climatic conditions resulting in

temperature extremes, heat waves, extreme changes in precipitation leading to flooding

and drought, sea-level rise, etc. have the

potential to adversely affect the generation

and transmission infrastructure of Greenko as

well as the asset’s productivity.

Transition Climate Risks

The transition risks of climate change are

the risks that could arise from the process

of adjusting to a low carbon economy such

as changes in policy, technology, market, and

reputation.

Regulatory Risks

In the drive for deep decarbonization and

tackling the adverse effects of climate

change, India will have to reform the energy

policy ecosystem and Greenko looks at these

upcoming changes in public policy as an

opportunity. To be on the top of these evolving

policies, Greenko continuously engages with

regulatory

processes

through

proactive

participation in discussions and public policy

advocacy with both National and Local

regulatory bodies viz., MoP, MNRE, MOEFCC,

and CERC providing constructive feedback

regarding policies and regulations.