Risk Management at Greenko is established on forward

planning, protecting autonomy, commitment to reach the

organization’s business objectives and the engagement of

senior management and the Board. Greenko’s risk profile

changes continuously and the risk management framework

effectively mitigates the potential impact to a level acceptable

to the Group’s strategy.

Risk Governance

The

growing

opportunities

in

renewable energy sector equally

possess certain strategic, functional

and operational risks. The elements

of risk management are judiciously

placed in Greenko’s organizational

structure and are well to harness

value pools. The board of directors and

the audit committee are supported by

the management to identify risks,

assess enterprise-wide effects, and

mitigate risks to create opportunities

out of it. An exclusive department

for risk management is created to

establish a framework and catalyze

the risk mitigation plan. Secretarial,

Legal and ESG departments assist

the Risk management department

in vesting the ownership of the Risk

Mitigation plan. This mechanism

has proved effective for Greenko in

driving risk management.

The integrity of our

business is continuously

tested in these uncertain

times. We, always ensure

that we conduct our

business responsibly

and ethically as this is a

part of our business DNA.

We perceive ethical and

professional behaviour

as our top priority and in

doing so we reinstate our

stakeholder’s trust.

- Vinay Bhatia

General Counsel

Risk Management Framework

The Greenko Risk Management Framework

(GRMF) is engineered to recognize and oversee

future risks and protecting the interests of

the organization’s business objectives. The

Committee of Sponsoring Organizations of

the Treadway Commission (COSO) and some

elements of Operationally Critical Threat,

Asset, and Vulnerability Evaluation (OCTAVE)

form the basis of GRMF. The internal risk

control systems are periodically monitored

by the Board and Audit Committee to identify,

manage, and address the risks.

GRMF allows the Board and management to

track and evaluate risks from an enterprise

standpoint, empowering the organization to

achieve the following business objectives:

-

Strategic- Aligned with VMV and Strategic

Objectives

-

Operations- Effective and efficient use of

resources.

-

Reporting-

Credible

and

reliable

disclosures.

-

Compliance- Comply with applicable

laws, regulations, codes, and voluntary

commitments.

Greenko’s top management plays a critical role in GRMF, while it is jointly handled by Risk, Legal and Compliance functions.

GRMF is used to evaluate risks related to any alternative ways considered by the management to meet the group’s strategic

objectives. In the instance of IRESP, prior to finalizing the size, scale, location, and timing, the management has determined

that their strategy is within their overall risk appetite. Greenko’s business-level objectives are achieved by focusing on business

strategy and objectives which are broken into sub-objectives for various activities such as GAM, Commercial, Projects,

Procurement and other functions.

Greenko’s Risk Management Framework

The Greenko Risk Management Framework consists of eight components2:

-

Internal

and

External

Environment

-

Examining

internal and external factors is

considered the most important

task. The Board sets a philosophy

regarding risk and establishes a

risk appetite.Further, it sets the

basis for how risk and control are

viewed and addressed.

-

Objective Setting - Objectives are

aligned to support the Greenko’s

Vision and Mission and are

consistent with its risk appetite.

-

Event Identification - Identifying

potential events from internal or

external environment affecting,

both positively and negatively, the

achievement of objectives.

-

Risk Assessment - Identified

risks, associated with hindrance

or enhancer of objectives, are

assessed

on

both

inherent

and residual basis, with the

assessment considering both risk

likelihood and impact.

-

Risk

Response

-

Possible

responses to risks, which include

avoiding,

accepting,

reducing,

and sharing risks. Management

selects a set of actions to

align risks with the entity’s risk

tolerances and risk appetite.

-

Control Activities - Policies and

procedures are established and

executed to help ensure the risk

responses.

-

Information and Communication

- Relevant information is identified,

captured,

and

communicated

in a form and timeframe that

enable people to carry out their

responsibilities.

-

Monitoring - Then the entirety

of

ERM

is

monitored,

and

modifications made, as necessary.

Risk Management Structure

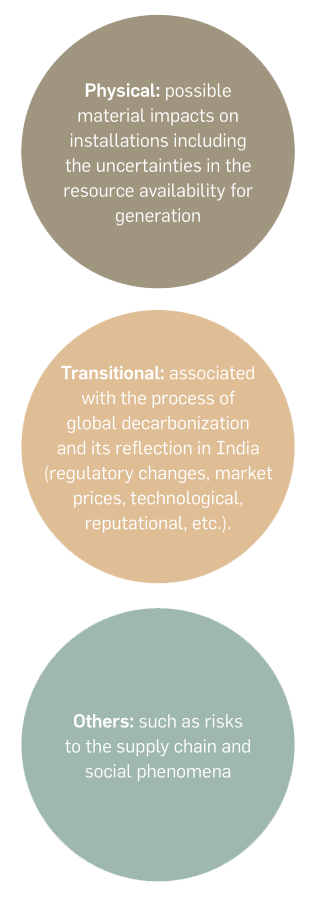

Climate Risk Assessment and Management

Greenko is committed to ‘Climate

Risk Assessment and Management’

as part of its Risk Management

System, with the aim of making

informed choices, building capacity,

planning,

prioritizing,

mitigating,

and adapting measures to reduce

its vulnerability to climate change.

This entails proactive and systematic

identification and analysis of the

potential

climate-related

hazards

to Greenko’s operations, based on

projections of climate change models.

The integration of climate risk

assessment

in

the

existing

framework

was

carried

out

by identifying the physical and transition

risks of climate change that have

the potential to profoundly impact

Greenko’s business. Presently, the

climate risk assessment is conducted

for its critical operating sites.

Mitigating

climate

risk

is

a

continuous process and Greenko’s

Risk Assessment and Management

Framework enables the company

to build resilience against variations

in climate by taking account of all

the potential climate risks in its

operations and planning appropriate

mitigation strategies.

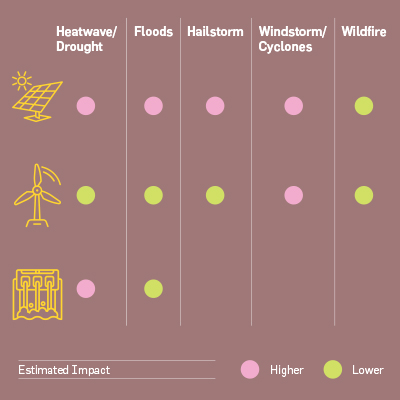

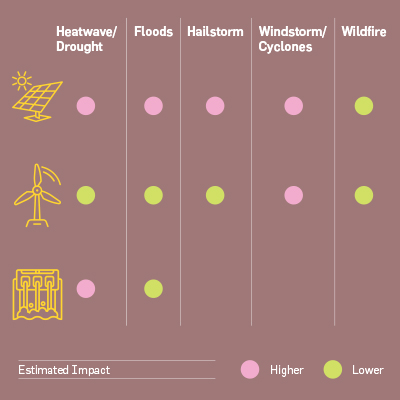

Scenario Planning – Risks and Opportunities

As part of its climate risk management

strategy, Greenko has over the short

term identified the risk of extreme

weather events and will implement

actions targeted towards reducing its

impacts on business. The company has

identified the above events using the

existing Early Warning System which

has now incorporated the monitoring

and warning of global warming induced

extreme events (acute risks), whose

frequency and severity are projected

to increase, owing to climate change.

This is crucial to proactively protect

and minimize the impacts of climate

change on the company’s assets and the

surrounding community, it operates in.

It is essential for the company to build

a resilient infrastructure and network to

mitigate climate related impacts.

Climate Risk Governance

The assessment of climate risk and

mitigation of its impacts is the first

priority for Greenko. To be able to do

this, climate risk assessment was

included in the GRMF as per suggestions

of the Board. Further, the company’s

Board of Directors reinforced Greenko’s

commitment to the UN’s Sustainable

Development Goals, especially numbers

7 — affordable and clean energy and

13 — climate action. The management

undertook the climate risk assessment

accordingly during 2020.

Climate Risk Strategy

While preparing a company’s future

strategy, the impacts of climate change

are

increasingly

taking

precedence.

Greenko has a vision of decarbonizing

the energy system through digitalization

and decentralization which has already

translated into strategic objectives and

the organization is pursuant to achieve

them. The group’s ability to capture and

convert

renewable

sources

into energy is always subjected to

material uncertainties of climate

change.

Greenko

continues

to

evaluate physical climate risk to its

own assets along with the electric

system in India to select a growth

strategy, choice of location and use of

technology.

Climate Risk Assessment

Greenko has examined the various

impacts

of

different

climate

scenarios in 2020, which included

the policy scenario of acceleration

of renewable energy adoption by the

Government of India and the physical

scenario of climate change as per

Global Climate Change scenario

RCP 4.5. This modelling confirmed

that the group’s business model can

tolerate the challenges that can arise

from climate change. The analysis

also put in place operational steps

at each site, in addition to the risk

assessment criteria, while evaluating

new assets and technology choices.

In the case of physical impacts

derived from the main climatic threats

and the increase in the frequency and

severity of extreme weather events,

Greenko has plans and systems to

improve the resilience of all assets

and components. Also, it has begun

discussions

with

the

insurance

institutions to cover climate risk

resulting in extreme weather events.

Greenko does not foresee that these

risks will have a catastrophic or

permanent impact on the assets

and

revenues.

The

organization

has a diversified portfolio of assets

spread across different states and

topographies.

Although

a

slight

increase in operational expenses is

anticipated, there are also plenty of

opportunities in the decarbonization

of the energy system in India.

Metrics and Targets

The climate change adaptation and

mitigation strategies are integrated

into Greenko’s Risk Management

Framework. A climate change specific

strategy has been devised and it

monitors and measures relevant

indicators such as its contribution

to the decarbonization of electricity,

under

GRMF.

Critical

business

indicators such as greenhouse gas

emissions, emission intensity across

the life cycle, water recharged and

reused, the extent of digitalization,

etc. assist the company to monitor

and plan targets.

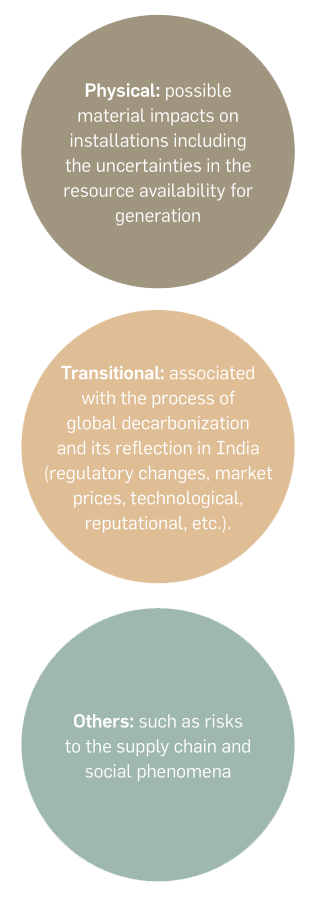

The GRMF considers and monitors

the risks derived from climate

change:

1(GRI 102-11, 102-15, 102-33) | 2(GRI 102-34)