In GIC, we believe that companies with good sustainability practices will generate

better risk-adjusted investment returns over the long term, and that this relationship

will strengthen over time. With the general direction of economies towards net

zero carbon emission, the Greenko leadership team has done well in positioning the

company sustainably. By focusing on key ESG issues, and staying ahead through

continuous innovation as demonstrated by Greenko’s journey to date, we are

confident in the company’s ability to grow and sustain its performance.

In GIC, we believe that companies with good sustainability practices will generate

better risk-adjusted investment returns over the long term, and that this relationship

will strengthen over time. With the general direction of economies towards net

zero carbon emission, the Greenko leadership team has done well in positioning the

company sustainably. By focusing on key ESG issues, and staying ahead through

continuous innovation as demonstrated by Greenko’s journey to date, we are

confident in the company’s ability to grow and sustain its performance.

(Board Director)

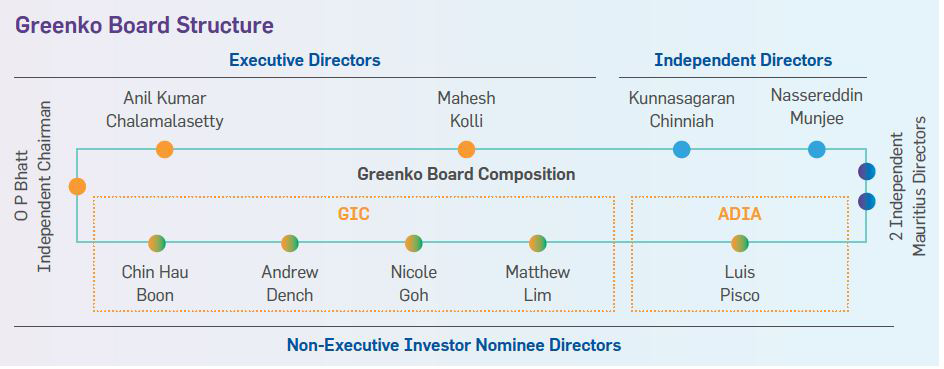

The corporate governance framework at Greenko is a set of practices and structures through which the company manages business affairs and works to meet its financial, operational, and strategic objectives to achieve longterm sustainability. Through adherence to best practices and principles of corporate governance, Greenko will continue to enjoy stakeholder trust and be a strong, viable competitive corporation accountable to stakeholders. The governance framework is crafted considering

The Governance Framework at Greenko is structured based on the following principles:

Ethical approach – culture, society; organizational paradigm

Balanced objectives – congruence of goals of all interested parties

Each party plays its part – roles of key players: shareholders/directors/ staff

Decision-making process in place – reflecting the first three principles and giving due weight to all stakeholders

Equal concern for all stakeholders – albeit some have greater weight than others

Accountability and transparency – for all stakeholders

The Greenko governance framework has the following salient elements’

Steering for the Long-Term

The vision and mission of the company are long-term, and the shareholder interests too are aligned for the long-term. To continue a focus on decarbonization, digitalization, and decentralization of the Energy System in India and harness all value pools, Greenko cannot afford to be immobilized by the demands of quarterly results. Thus, the group’s focus of deliberations and communication is about long-term goals, such as market share targets, percent of revenue from new markets, besides quarterly earnings guidance. Greenko follows a staggered representation of the board and this promotes continuity and stability in the boardroom.

Best in the Board

Greenko’s Board ensures that its membership has the proper mix of skills and perspectives. To ensure this, the Board not only follows age limits and term limits but also gender and other diversity requirements. The Board takes a hard look at their composition and whether the skill set is appropriate for the company and its ambitions for growth. The Board presently has internal evaluations conducted by the chairman or lead director and process design for reviews involving grading directors on various company-specific attributes.

Orderly Voice to Shareholders

Greenko’s executive directors would campaign hard for their point of view but leave the decision to the shareholders and guarantee a reasonable process whereby shareholders get to decide.

Further at Greenko, we follow the best corporate governance practices, as below:

Define roles and responsibilities

Further the following good governance practices are adhered to at Greenko:

Emphasize integrity and ethical dealing

Evaluate performance and make principled compensation decisions

Effective Risk Management