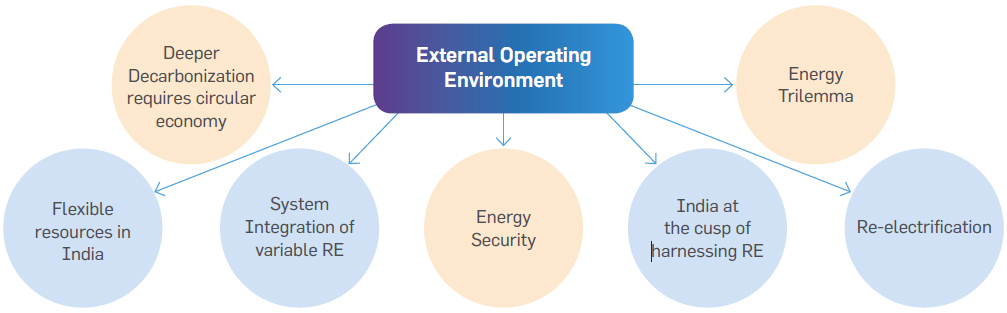

Elements of External Operating Environment

Driven by an expanding population and increasing prosperity, global energy consumption has significantly increased over the last decades. Demand has risen for virtually all sources—coal, oil, natural gas, nuclear energy, and renewables. At the same time, rising fossil fuel consumption is the leading cause of global climate change and creates other major environmental challenges. To address these challenges, the global energy system will need to undergo a clean energy transition, whereby sources of energy that emit greenhouse gases are replaced by increasingly cleaner sources. The decarbonization drive initially spurred by UNFCCC and Kyoto protocol, now has gained momentum of its own. While the Paris Climate Goals continue to be the pivot, the technological developments (digitalization) and other social trends (decentralization) have reinforced decarbonization.

Further, in a global economy shaken deeply by COVID-19, short-term demand declined for fossil fuels, while renewables have grown slightly across all geographies. The International Energy Agency (IEA) estimates that primary energy demand in 2020 could decline for oil (–9%), coal (–8%), natural gas (–5%), and nuclear (–2%), while renewables would grow by 1%. However, the uncertainty of future GDP across nations and energy trends are immense and worrying.

The IEA estimates that emissions could fall by roughly 8% this year, returning to their 2010 levels. However, in the absence of climate policies during the pandemic and aggressive return to economic growth could render the achievement of the Paris Agreement targets difficult. This calls for post COVID agenda with substantial new policies and widespread deployment of low-, zero-, and potentially negative-emissions technologies.

Since 2009, the levelized cost of solar photovoltaic (PV) power has declined by nearly 90%. Over that time, global solar electricity production has grown more than tenfold. But this may be just the beginning. By 2040, multiple scenarios project that solar will provide over 20% of the world’s electricity. Though it is very encouraging, this share of solar photovoltaic and similar share of wind and hydro by 2040 would be barely adequate to limit the global temperature rise to 2 degrees.

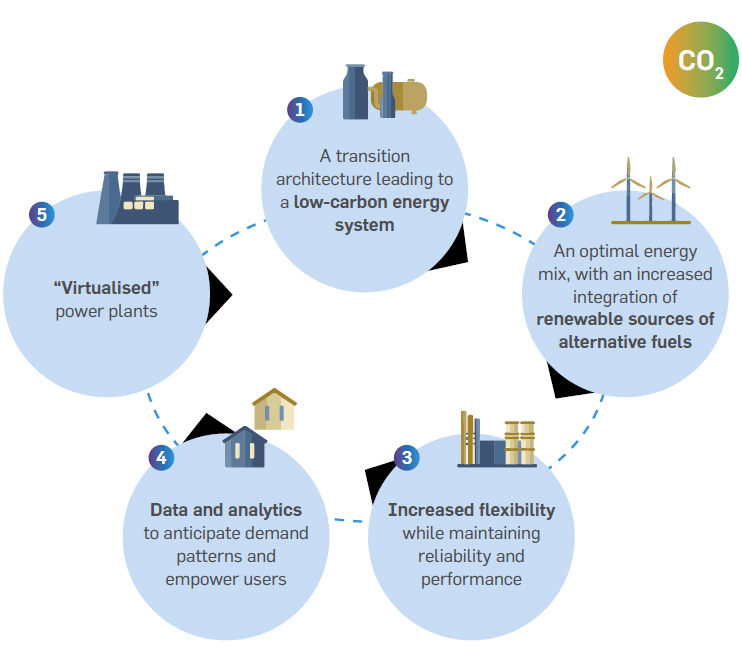

To address the challenging climate goals set in the Paris Climate Agreement, the global energy system has to continue with the ongoing pursuit of increasing the share of renewables. Two additional factors that are added to the current energy scenario, to make it a trilemma are: digitalization and decentralization. These trends, if crafted and curated in the right fashion, can be effective tools in deeper decarbonization and at the same time deliver affordable and reliable energy. It is obvious that digital technologies are transforming business at an unprecedented pace and heralding Energy 4.0. Digitalization catalyzes the decentralization of energy i.e., both generation and use, possible and effective. This “3D” view, i.e., Decentralized, Decarbonized, and Digitalized, of energy is based on five pillars:

Five Pillars of Energy System Transformation

Each of these pillars have many challenges but, it is being addressed by businesses and governments. The transition architecture is in place in many countries and most INDCs have defined their optimal mix and the share of renewable energy to be targeted. However, the required flexibility in the grid and the generation systems is not yet developed. The energy storage systems to support flexibility is being put in place in some countries. Exploration of the digital world for a better understanding of the uses and effective deployment of virtualized power plants is on.

The future of the energy system is irreversibly heading to a low-carbon economy. The increased decentralized and digitalized scenario is a good opportunity to define the required transition architecture for the energy system.

Re-electrification is reinforcing electrification with renewables. Over the course of human history, the transition from one major form of energy to another happened several times – from animal power and biomass to burning coal, and then to the increasing use of oil and gas. The world is already in the midst of another historic shift away from these fuels. But to meet sustainability and climate goals, the pace of change must accelerate. We need to expand renewable capacity and create a smarter and much more flexible electricity grid, increase the number of vehicles and other products and processes that run on electricity.

The energy trilemma – decarbonization, digitalization, and decentralization, is to be reinforced by increasing electrification. In a low-carbon power system, electrification can have a significant impact on carbon emissions by 2040, reducing emissions by 10-20%, compared to a baseline. In a world where power generation is decarbonized, RE is the main form of energy that can help reduce CO2 emissions significantly by accelerating the decarbonization of energy supply and by improving energy productivity.

Electricity today accounts for 19% of total final consumption of energy and the share is expected to reach in the business-as-usual scenario to 24% in 2040, very much behind full electrification. Also, not all end uses can be readily electrified, such as high-temperature heat demand in industry, long-haul aviation, and shipping, where electrification is harder to achieve due to either economic or technical barriers.

Technological innovations and policy Interventions around sustainable development and climate change are driving an urgent energy transition in this century. This transition towards clean electricity is combined with ‘smart’ digital technologies that make it possible to take full advantage of the growing amounts of cheap renewable power. This vision, which IRENA coined as RE-electrification, unlocks the potential synergies between major increases in the use of electricity and renewable power generation by coordinating their deployment and use across demand sectors – power, transport, industry, and buildings. As the digitalization and strong global climate policies become pervasive in the future, the electrification of energy services will be catalyzed. Electric or fuel cell vehicles would largely replace fossil-fuelled cars and trucks, and heat pumps and electric boilers would substitute for oil and gas furnaces in buildings and industry. Electricity from renewables could also be used to make hydrogen or synthetic gas for applications where direct electrification is difficult.

Widespread electrification together with digital technologies and renewable power can become a central pillar of energy and climate policy, given their numerous benefits. RE-electrification can make power systems more flexible, resilient, secure, and less reliant on fossil fuels. Over and above, it offers significant efficiency gains in primary energy use. It reduces pollution, leading to improved health. The modern automation and control systems that are an integral part of RE-electrification can also boost economic productivity and improve the quality of living conditions.

RE-electrification strategies have to look beyond the generation side of the power system and tap all available sources of flexibility including demand over a wide range of time scales. The charging of electric vehicles (EVs) can be ramped up or down within milliseconds or shifted by several hours. RE-electrification requires smart devices and other information technologies that offer much more flexibility and control over demand and the delivery and use of renewable electricity. Smart approaches in combination with digitalization are key to reducing risks of rising peak loads, to expand opportunities for renewable power utilization, and to avoid massive investment in building new grid infrastructure. This virtuous cycle, where electrification drives new uses and markets for renewables, then accelerates the switch to electricity for end uses, creating more flexibility and thus, driving further growth of renewables and technological innovation.

This major transformation will encounter many challenges. Energy systems are both complex and highly integrated, making them difficult to change. On the policy side, they are highly dependent on entrenched regulations, taxes, and subsidies, which require considerable political will to adjust. Further, transforming markets and supply chains – e.g. the automobiles shifting to EVs, or home heating to heat pumps – may still take many years. Any transition also creates winners and losers, and the distribution of cost and benefits needs to be fair in order to achieve broad acceptance. On the technical side, a transition to the widespread use of renewable electricity also has considerable challenges. It requires integrating large amounts of variables into the grid, which involves matching supply and demand in the face of varying generation that may not match peak demand. It requires improved coordination between sectors of the economy, both in planning and operation and building of new infrastructure.

The basic technologies needed for the transition already exist. Still, innovation remains critical.

Innovation in technologies needs to go hand-in-hand with improvements in new hardware, software, and services. Together, all these innovations can accelerate the energy transition.

India has made huge strides to ensure full access to electricity, bringing power to more than 700 million people since 2000. The pursuit of ambitious deployment of renewable energy, notably solar, and energy efficiency in lighting through Ujala and providing 80 million households with liquefied petroleum gas connection (under the Pradhan Mantri Ujjwala Yojana scheme) are some noteworthy ones amongst many initiatives.

India is also introducing important energy pricing reforms in the coal, oil, gas, and electricity sectors to improve the financial health of multiple institutions and the whole ecosystem. It is taking significant steps to enhance energy security by fostering domestic production through the most significant upstream reform of India’s Hydrocarbon Exploration and Licensing Policy (HELP) and building dedicated oil emergency stocks in the form of a strategic petroleum reserve.

Reform of India’s electricity sector will need to be comprehensive to achieve energy security and will require affordable and reliable power for driving economic growth. The Central Energy Regulatory Commission (CERC) has made progress and working towards a country-wide wholesale market is a backbone for the national grid. The key to this success will be building a joint vision and a common reform roadmap among a broad range of central government agencies, state authorities, system operators, and utilities.

India also faces the challenge of ensuring the financial health of its power sector challenged by surplus capacity, lower utilization of coal and natural gas plants and increasing shares of variable renewable energy. The government is working to improve the financial viability of the power sector. The “stressed assets” in coal and gas-fired generation are being offered measures to enhance the economic efficiency of coal and gas supply for power generation and the availability of finance. The creation of a competitive wholesale power market will be vital for improving the utilization of India’s generation capacity.

Energy security

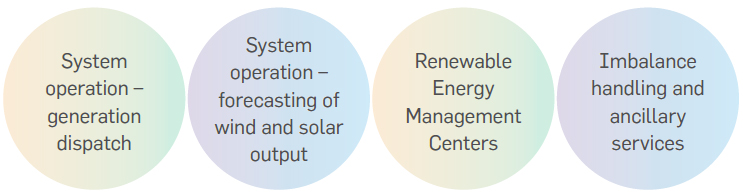

India’s electricity security has improved markedly through the creation of a single national power system and major investments in thermal and renewable generation. India’s power system is shifting to higher shares of variable renewable energy, which is making system integration and flexibility a priority. The Government of India has supported greater interconnections across the country and now requires the existing coal fleet to operate more flexibly. It is also promoting affordable storage. It is now exploring a diverse mix of flexibility investments for the successful system integration of wind and solar PV viz., flexibility from the coal and natural gas capacity, variable renewables themselves, energy storage, demand-side response, and smart grids. To fully activate a diverse set of flexibility options, the government will put in place electricity market reforms that enable the appropriate price signals for various value pools and create a robust regulatory framework

Based on current policies, India’s energy demand could double by 2040, with electricity demand tripling because of increased appliance ownership and cooling needs. If other sectors also electrify at a good pace, the electricity demand by 2040 may increase by five times. India had deployed a total of 84 GW of grid-connected renewable electricity capacity by 2019 against the target of 175 GW of renewables by 2022. In September 2019, the prime minister of India, Shri Narendra Modi, announced that India’s electricity mix would eventually include 450 GW of renewable energy capacity.

Progress towards these targets will require a focus on unlocking the flexibility needed for effective system integration. This can potentially be achieved by improving the design of renewable auctions (e.g., SECI auctions), with clear trajectories and criteria to reflect quality, location, and system value, along with measures to foster grid expansion and demand-side response across India.

The Energy Roadmap may contribute to broaden national priorities such as the “Make in India” manufacturing initiative to produce solar PV, lithium batteries, solar charging infrastructure, and other advanced technologies in India. The innovation efforts in a broad range of energy technology areas, including cooling, electric mobility, smart grids, and advanced biofuels are actively being promoted.

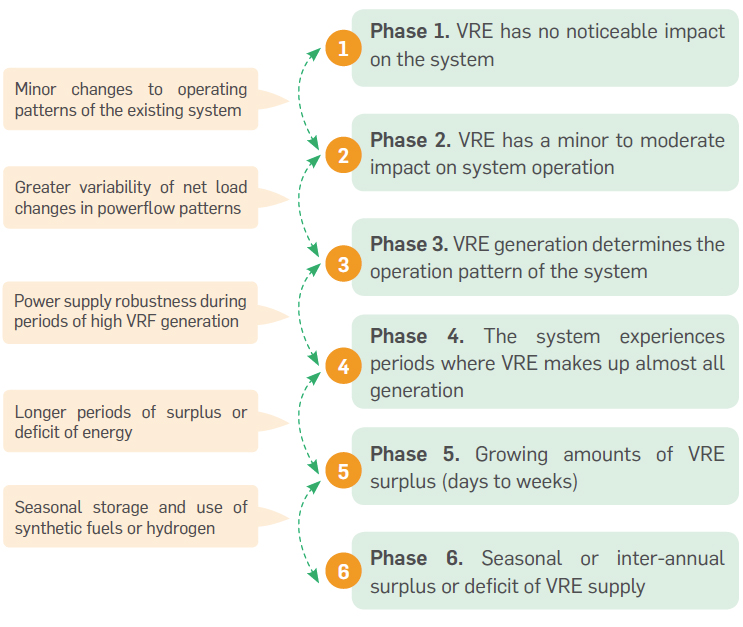

The five states (Karnataka, Tamil Nadu, Rajasthan, Andhra Pradesh, and Gujarat) are already facing significant system integration challenges, with solar and wind shares above 15%. In the future, more Indian states will experience even higher shares of variable renewables. As India decarbonizes and moves towards its 175 GW goal, this may create new challenges and those states will be required to make significant changes to how they operate their power systems.

The need for flexibility is increasing and can create the opportunity for growth and innovation at the national and state levels in India. Increasingly, India will need to broaden the focus from power system flexibility coming from thermal plants (coal) to use all sources of flexibility (renewable power generators, grids, storage, and the demand side), based on a thorough analysis of power system transformation and flexibility needs. This will create new value pools for businesses to harness decarbonization, digitalization, and decentralization of energy in India.

Key characteristics and challenges in the different phases of system integration of VRE

Source: IEA (2018a), World Energy Outlook 2018.

To improve the system flexibility, India has taken several steps and notable amongst these are;

Four categories of electricity infrastructure assets are critical for system flexibility: a) conventional and variable renewable resources; b) electricity networks; c) distributed energy resources; and d) energy storage. Conventional power plants, electricity networks, and pumped storage hydropower have historically been the primary sources of flexibility. However, as operational protocols modernized, improvements in VRE power plants, smarter electricity networks, and more affordable distributed energy resources and battery electricity storage, a wider set of flexibility options are now available. As power systems transition towards higher phases of system integration, these flexible resources can be adapted to work in a cost-effective, reliable, and sustainable manner. India is considering these changes to the policy, market, and regulatory frameworks to achieve effective system integration.

In India, Pumped Storage remains the most widely deployed utility-scale storage option. By absorbing off-peak energy and providing peak power, PSH also improves the overall economy of power system operation and increases the capacity utilization of thermal stations. To support system flexibility, India has significant hydro reservoir capacity and a large PSH potential, which, however, remains untapped. Out of more than 90 GW of PSH potential in the country, only 4.8 GW is designed and is capable of operating as pumped storage units. The 4.8 GW of capacity is provided by nine PSH plants. Only 6 power plants (24 units) with a capacity of 3.3 GW are operational today.

Energy storage systems could have a wide range of owners: generating companies, distribution licensees, transmission utilities, merchant power plants, bulk power consumers, or unrelated third parties. The dependence of regulatory treatment on the ownership of energy storage assets which include market entry fee, cost recovery structures/mechanisms (pricing), grid integration, use of licensee’s assets, and revenue sharing, etc., is a challenge. For instance, storage facilities owned by the transmission or distribution licensee may be used to maintain grid stability, to relieve congestion in the grid, and to shift conventional generation to meet peak demand.

The storage assets can be used by generating companies to reduce bulk/industrial consumers’ reliance on Distribution Companies as a back-up. The cost recovery mechanisms vary, depending on the dedicated use of the energy storage systems by the generating company or the transmission licensee, the cost of such storage system and that of service of energy storage can be considered in the tariff determination of the generating company or the transmission licensee. Recently, such a structure has been considered by Solar Energy Corporation of India (SECI) which has invited bids for setting up renewable energy projects with energy storage units. As opposed to the aforesaid, energy storage systems can be for shared purposes, the developer of such facilities could enter into multiple contracts with the proposed users for recovery of cost.

Another area of concern with respect to energy storage systems is the determination of the jurisdiction. For example, if a storage facility is an inter-state transmission asset, it could be CERC, if they are for a specific generating company, then the State Commission.

The India Energy Storage Alliance (IESA) has estimated over 70 GW and 200 GWh of energy storage capacity in India by 2022, which is among the highest in the world. However, a comprehensive policy and regulatory framework for energy storage, similar to India’s policy on renewable energy is essential.

Recently ‘hybrid wind-solar with storage’ policy is amended to clarify that any form of storage – not just batteries – could be used in hybrid projects, including PHS, compressed air, and flywheels. Then, in March 2019 India’s Ministry of Power proposed electricity rule changes to incentivize electricity supply at times of peak demand, a key pricing signal needed to underpin the financial bankability of storage projects.

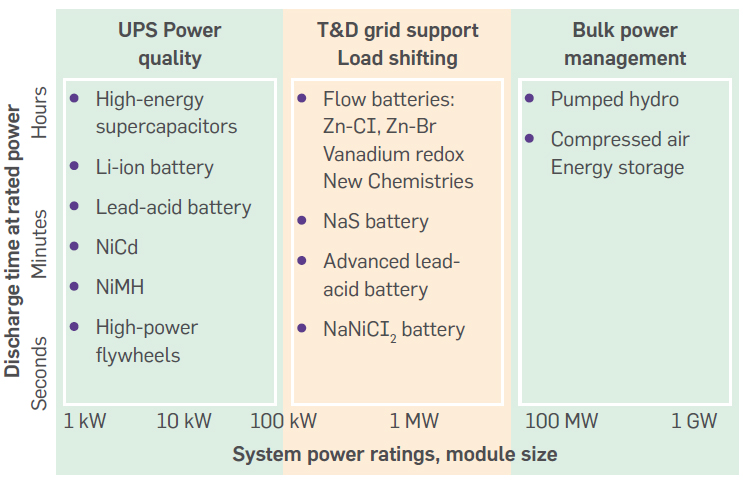

Characteristics of RE storage technologiesthe

Contrary to the dominant perception that batteries will gobble up the new storage opportunities (like the US, EU, and Korea), a recent SECI tender, which floated the world’s largest renewablescum- storage tender, provided an interesting twist. The tender required assured peak power and Greenko won 75% of the tendered capacity at a peak+off-peak tariff of Rs. 4.07.

This is the cheapest renewables-cumstorage tariff in history, anywhere in the world. The technology chosen is pumped hydro storage. The remaining part of the tender was won by RenNew Power with batteries, which is the world’s second cheapest tariff.

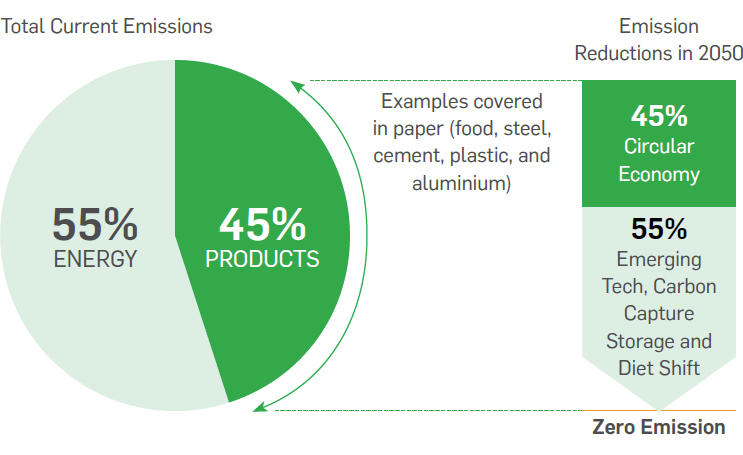

Presently, mitigation of climate change has focused mainly on the critical role of renewable energy and energyefficiency measures besides land use and land-use change strategies. The renewable energy, in a scenario where a significant component of energy is electrified, would only address 55% of required emission reductions to reach Net-Zero by 2050. Hence, meeting climate targets will also require tackling the remaining 45% of emissions associated with making products. A circular economy offers a systemic and cost-effective approach to tackling this challenge.

Estimated advantages of emission reduction in 2050

Our ‘Take-Make-Waste’ linear economy relies primarily on extraction, is resource-intensive, and produces significant greenhouse gases (GHGs) that are causing the climate crisis. Companies extract materials from the earth, apply energy and labour to manufacture a product, and sell it to an end-user, who then discards it at the end of its life. Circular economic approaches would extend the life of assets and enable recycling and reusing of the assets, thus reducing the need for extraction, refining and processing of virgin materials.

Systemic transformation of energy and industrial systems, land management, buildings, and infrastructure will have to be achieved to reach net-zero emissions by 2050 and therefore, limit global warming to 1.5˚C. NDCs are currently estimated to reduce global emissions in 2030 by 3-6 billion tons CO2. Nations will therefore have to increase their ambitions fivefold to meet the emission targets, consistent with the 1.5˚C scenario.

With renewable sources projected to supply more than 60% of global electricity in 2050, the Net Zero by 2050 cannot be achieved. This would require six times faster renewable energy generation growth, significant storage infrastructure, and doubling the share of electricity in energy. The adoption of the circular economy in the industrial and food ecosystem can address another significant part of the decarbonization target.

Emission Reduction Pathways

Circular Value Pools in Solar PV

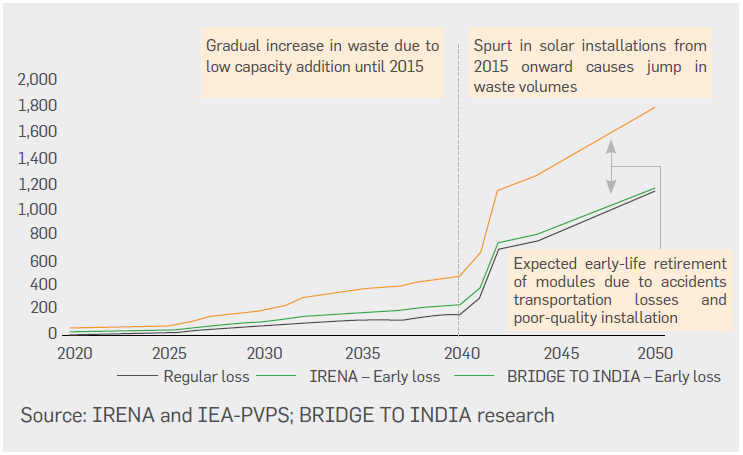

It is estimated that the PV waste is 250,000 metric tons in 2016 and this will increase further and will contribute 4% of the installed PV capacity by 2030s. However, there are unique opportunities for creating economic value from the PV waste (e.g. recovery of raw material, the market for new PV recycle industries, etc.). The EU member states have taken initiatives for establishing the regime for PV module collection and handling in accordance with Waste Electrical and Electronic Equipment Directive (WEEE Directive). Further, PV manufacturers have also developed voluntarily a few models for PV recycling: First Solar, Solar World Global, and PV Cycle. First Solar’s industry-leading recycling services enable PV power plant and module owners to meet their module end-of-life (EOL) obligation simply, cost-effectively, and responsibly. Solar World program is offering to recycle of PV modules that have undergone any type of damage (e.g. glass breakage, defective laminate, or electrical faults). PV systems are increasing exponentially in India and end-oflife management policies regulations are being considered to support the transition to a sustainable PV life cycle program.

Estimated annual PV module waste generation in India

Embracing a circular approach to PV waste and material recovery will be necessary and an opportunity to harness value at the end of life. Further, extending the life of assets and having a modular approach at the design stage for second life are becoming the new normal in the RE sector. It not only helps to close the gap of the net-zero target but also offers new value opportunities to the business.