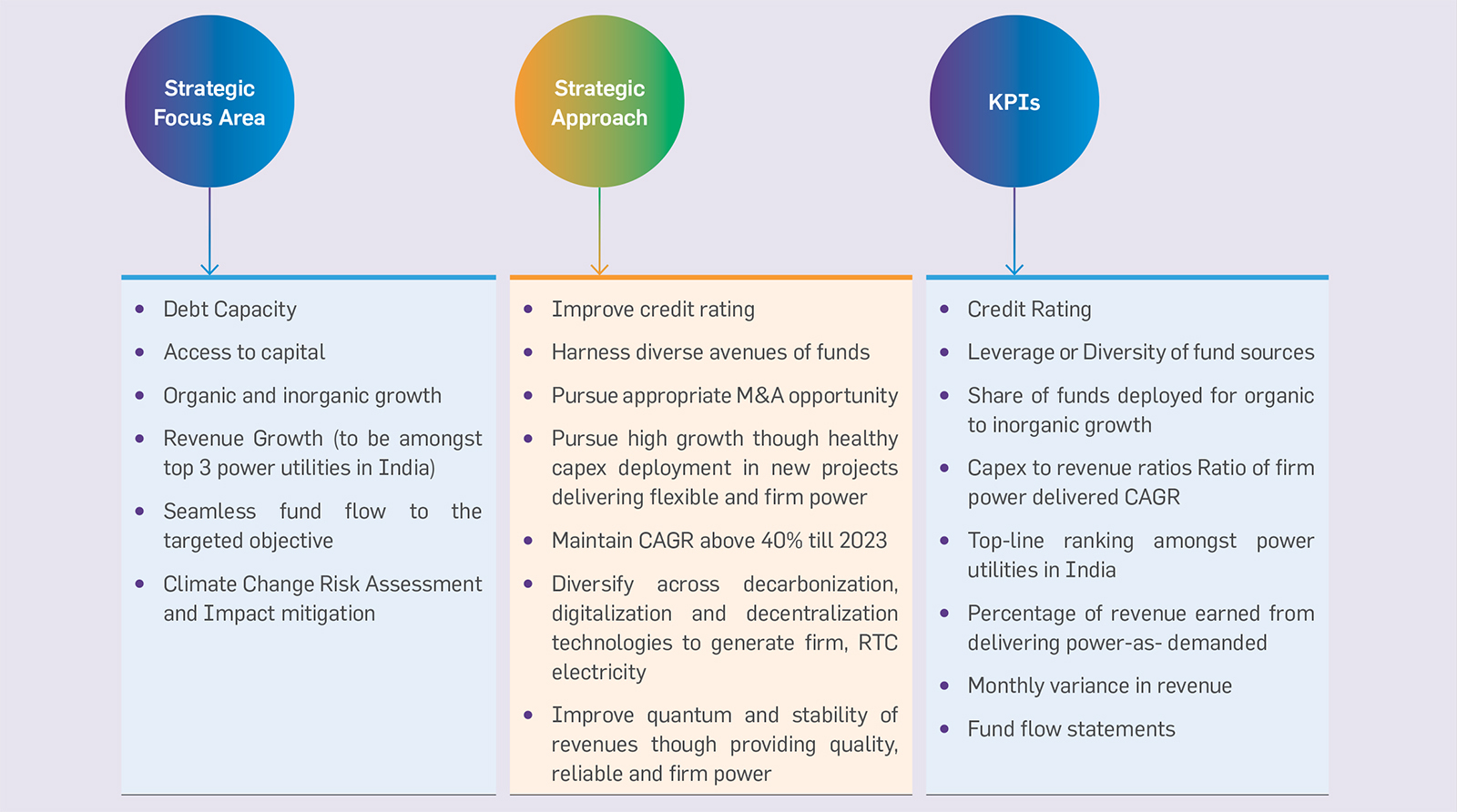

Greenko’s strong commitment to the principles of transparency and integrity enables the group in delivering consistent economic value to all its stakeholders. In the pursuit of its vision and mission, Greenko endeavours to tap diverse capital sources and pursue both organic and inorganic growth, aimed to be amongst the top 3 power utilities in India. To pursue the diverse opportunities of the energy sector Greenko strives to preserve and enhance its stakeholder trust continuously.

Strategic Direction: Preserve and Enhance Value for Shareholders

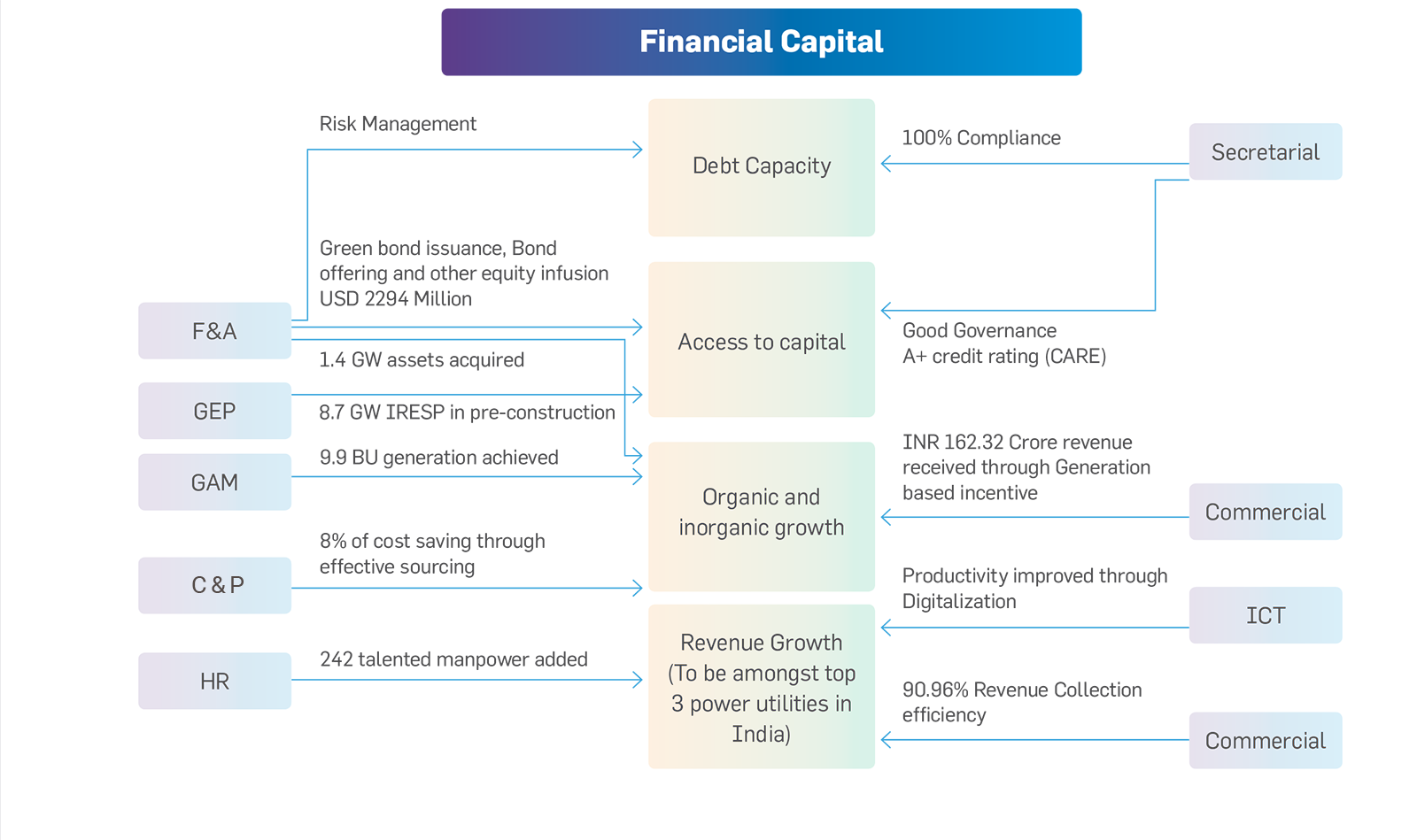

The availability of financial capital at the right cost and time is critical in the pursuit of its vision and mission. Greenko’s functions and businesses recognize and understand the concerns and expectations of capital providers, specifically regarding risk identification, control, and provisioning for residual risk in new projects, activities, partnerships and acquisitions. The group proactively addresses stakeholder expectations through strong governance and risk management practices.

Greenko continues to harness the increasing commitment to responsible investment amongst global investors. The fixed-income instruments, Green Bonds, that are specifically earmarked to raise money for climate and environmental projects, are issued by Greenko, to finance development and acquisition of the wind and solar projects.. The green bonds issued by Greenko Solar Mauritius Limited ,during this financial year are asset-linked and backed by the entity’s balance sheet. Greenko has diligently deployed the funds as per the use of proceeds specified and followed the process for evaluation and selection. Greenko has been regularly and diligently fulfilling its impact assessment and allocation reporting obligations as required by the green bond framework.

Read for more information on Greenko sustainable financing and impact reporting : http://www.greenkogroup.com/ sustainablefinancing.php#sustainablefinancing

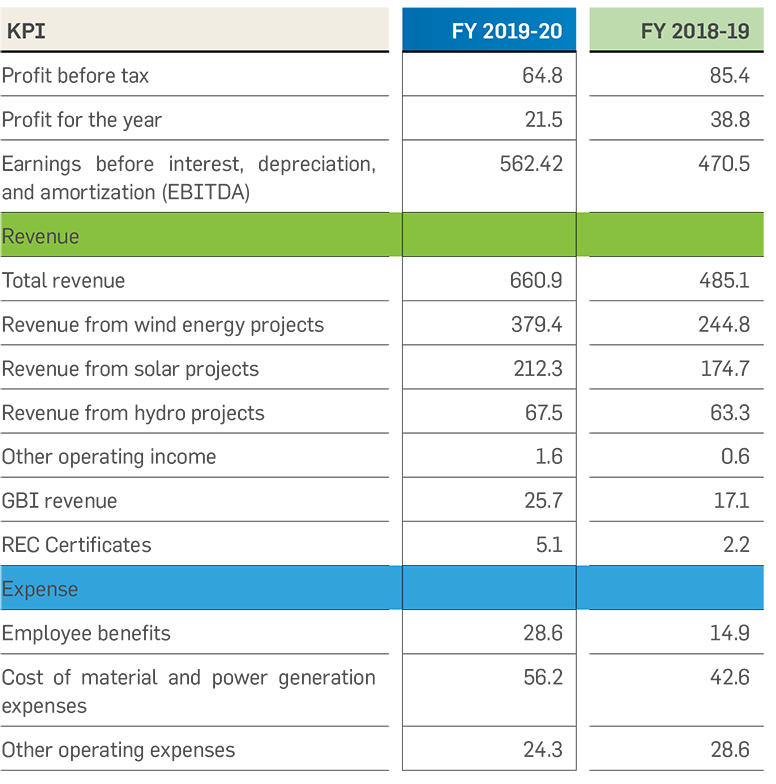

Greenko has performed well in the current reporting period, by consistently developing and reinforcing financial strength in line with its strategic approaches viz., pursuing revenue growth, organic and inorganic growth, enhancing debt capacity and access to capital. This is helping Greenko progress towards its ambitious goal of reaching 10GW of installed generation capacity, with the group having achieved more than half of its desired generation capacity already in the reporting period. This will not only enable Greenko to offer sustained and attractive returns to shareholders but also to other stakeholders. As would be evident from the performance reflected in the capital.

Greenko has accomplished to reach 6.2 GW installed capacity, in the current reporting period, to progress towards its goal of reaching 10GW of installed generation capacity. This scale of expansion was achieved by pursuing strategically both organic and inorganic growth. Accordingly, Greenko added nearly 1.4 GW of capacity in FY 2019-20 through acquisition of assets.

Further, in the current reporting period, Greenko remained the top destination for overseas funds in the sector with USD 2,294 million investment flows, more than double than its closest competitor in India. In line with good corporate governance, the group also raised USD 1,035 million through green bond issuance, thus continuing its journey of tapping sustainable finance

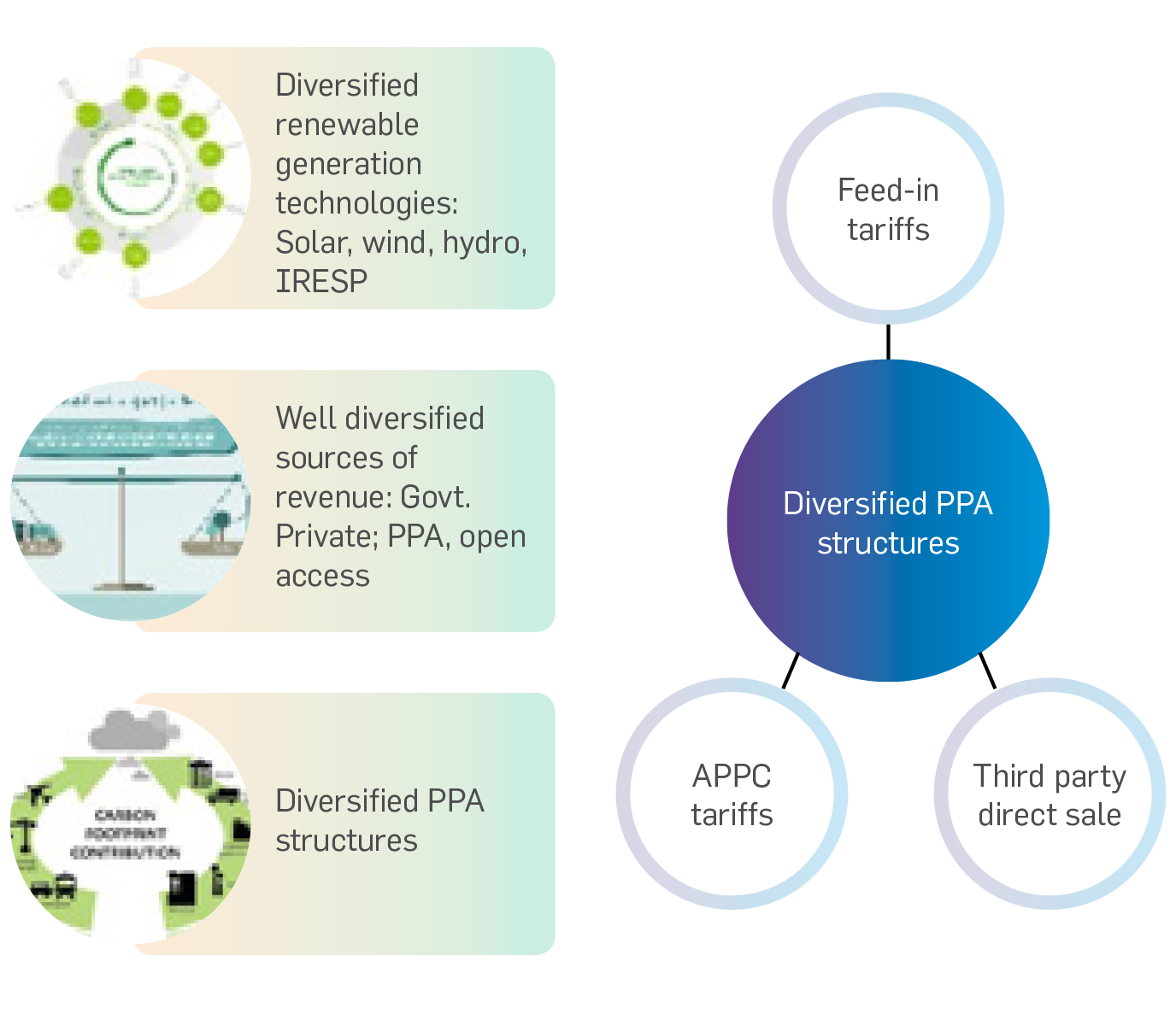

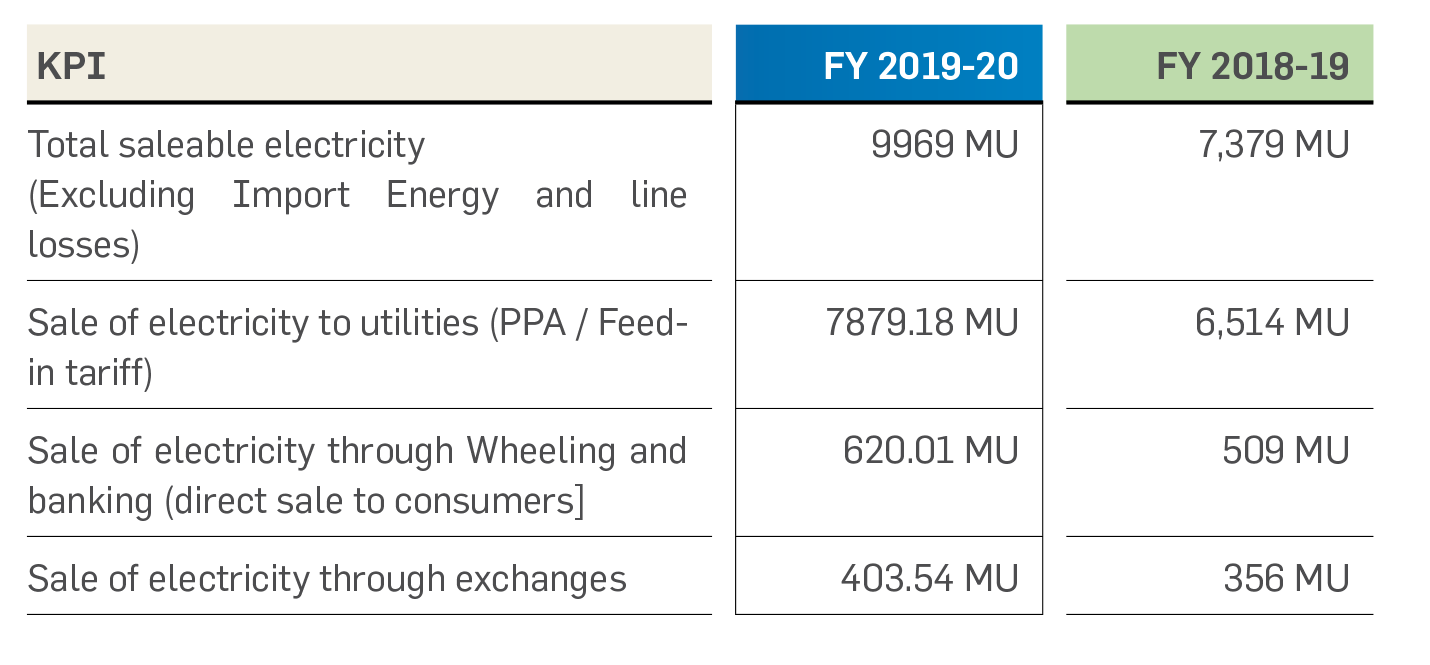

Greenko has maintained a good credit rating and has thereby, remained highly attractive to potential investors. It has been able to tap diverse sources of funds and has positioned itself among the top three renewable energy generators in India. Greenko has a well-diversified source of revenue – diversified renewable generation technologies and diversified PPA structures, including (i) Feed-in tariffs, (ii) APPC Tariffs, and (iii) Third-party direct sales.

The different generation technologies help to peak generation in different seasons of the year. The diversity of PPAs and the types of customers served due to reduction of regulatory and payment risks have ensured continuous cash flow for operational projects. Further, due to the different capital avenues that Greenko accesses, it can raise finance at competitive terms. In addition, the contribution of Greenko to public policy has improved its position in the sector.

The organization aims to harness overall organic & inorganic growth by embracing circular and regenerative thinking as a way of business. Accordingly, circularity and regenerative thinking are integrated across Greenko’s value chain, right from the selection of designs, technologies, and service providers to assessing the possibility of extending the life cycle, second life, and managing the end-oflife of assets.

Circularity at Greenko is harnessed at three levels,

Greenko’s Integrated Renewable Energy Project, which is designed to address inherent infirmity of wind and solar energy by employing the innovative solutions of Pumped Storage Plant (PSP), is an important component of our circular approach. These projects are designed as sharing platforms of storage and other electricity system services.

By virtue of the circularity and regenerative thinking approach, Greenko aspires to explore and employ innovative ideas and action plans, such as “invest-generate-and-Consume”, “harness increasing electrification’’, “solutions to non-electric use sectors”. In addition to addressing business performance enhancement, this approach also addresses human resource management through processes such as “Edge effect abundance”, “Empowered participation” and “Honours community and place”. The ideas conceptualized should necessarily address (i) meeting the community energy needs through crowdfunding; (ii) providing electrical solutions to non-electric uses and thereby accessing a new set of consumers.

The year 2019-20, was characterized by cost optimization, holistic wellbeing to achieve organic & inorganic growth in a circular and regenerative manner, wherein no men, machine, material, information, and money was allowed to stagnate. The money was continuously circulated back in the system to harness economic, social & environmental benefits.

We have systems in place to address many operational risks. The weather risk is managed through appropriate insurance. We are exploring the possibility of including the likely risks of climate change due to global warming in the insurance policy. These will include both acute risks viz., increased severity and frequency of extreme weather events and chronic risks viz., increased uncertainty in availability of wind, solar radiation, and hydrological flows.

We have systems in place to address many operational risks. The weather risk is managed through appropriate insurance. We are exploring the possibility of including the likely risks of climate change due to global warming in the insurance policy. These will include both acute risks viz., increased severity and frequency of extreme weather events and chronic risks viz., increased uncertainty in availability of wind, solar radiation, and hydrological flows.

Renewable energy has proven to be a key in the transition towards a low carbon future and to meet the 2 °C climate goal, to minimize the catastrophic impacts of climate change and address the growing energy demand. However, like every other sector, renewables are also susceptible to the impacts of the changing climate. The entire supply chain of the renewable energy system is significantly vulnerable to climate variability. While physical impacts altering the availability of renewable resources affect the overall generation potential and supply, extreme weather events affect the generation assets, transmission infrastructure, and variation in seasonal energy demand. In addition to physical impacts, transitional impacts such as regulatory and market change also remarkably affect the renewables.

Therefore, it is critical to take into consideration emerging climate change conditions and their impact before deciding about specific geography, design, construction, operation and maintenance strategies for existing energy infrastructure, new infrastructure, and future planning. For this purpose, Greenko has established a Climate Risk Assessment and Management framework and has conducted a Climate Risk Assessment study in the current reporting period to proactively and systematically identify and analyse potential climate changerelated hazards to its operations, based on historical events, trends, forecasts and projections from global warming models.

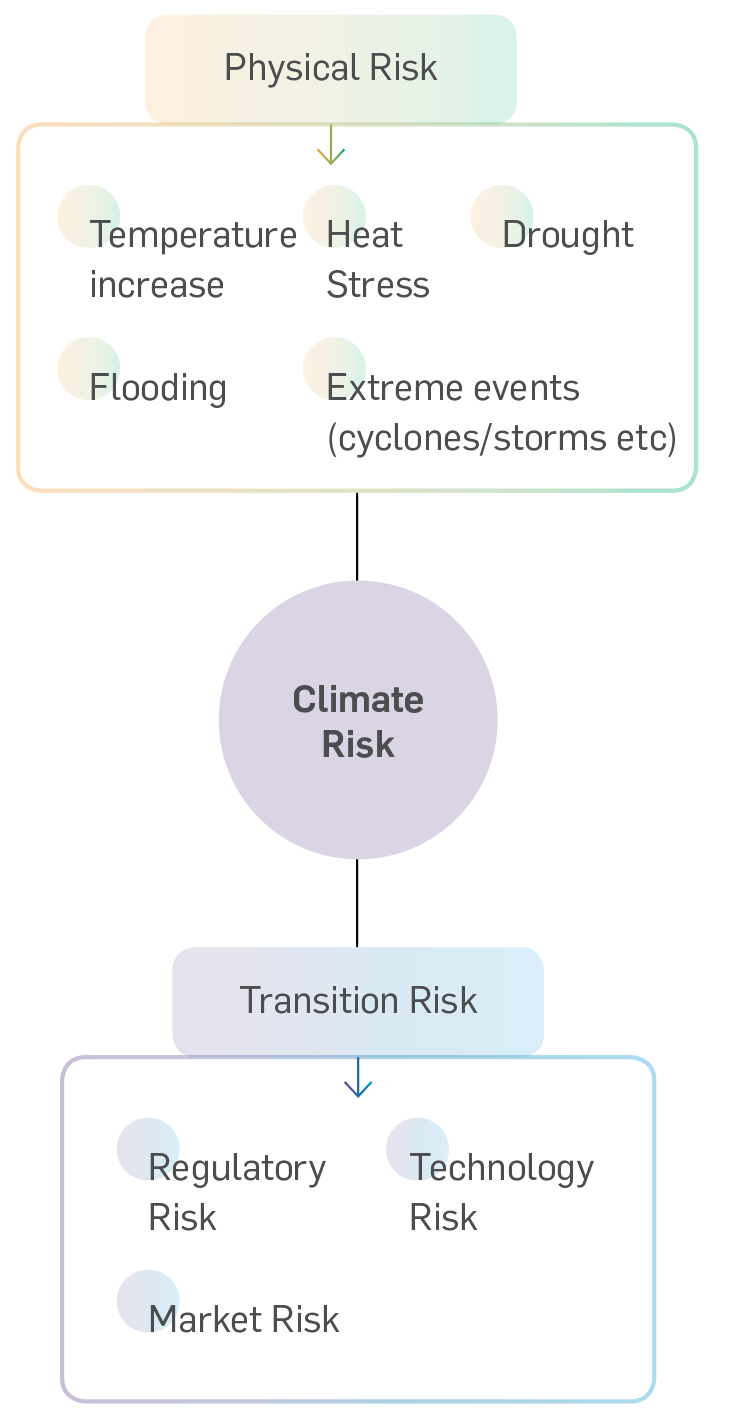

The two major categories of climate risks about which any organizations are focussed about are:

Physical climate risks

2 Transition Climate risks

Physical risks are what comes to mind when anybody think of climate risks. They can range from droughts to tropical storms. Physical risks can be separated into extreme events and incremental environmental changes. The two main categories of impacts of Physical Risks at Greenko are 1. Physical risk Impact on Resource Potential and 2. Physical risk impact on Generating assets.

The electricity production potential of renewable energy is critically impacted by the physical risks of climate change, due to its dependence on climate conditions. The climate change risk and its impact on Greenko’s generation potential, due to the shift in renewable resource patterns is assessed through an extensive literature review of studies that quantitatively estimate climate change impacts on renewable energy in India based on historical data, trends, and projections using global warming models.

The findings of the risk assessment on resource potential are summarised as follows,

From the above risk assessment findings, it is evident that Greenko’s generating assets are strategically distributed across geographies and thus, capable of effectively addressing the projected changes in the renewable resource potential. The majority of Greenko’s wind and solar portfolio are established in the southern regions of India, thus mitigating the negative impacts of climate change projected in western and northern India, for the respective portfolios. Moving forward, the future projects of Greenko will be strategically planned and designed in terms of geography, equipment specification, mitigation and adaption measures etc. in line the climate risk impact projections on generation potential.

A shift in climatic conditions resulting in temperature extremes, heat waves, extreme changes in precipitation leading to flooding and drought, sea-level rise, etc. have the potential to adversely affect generation and transmission infrastructure of Greenko as well as the asset’s productivity. Accordingly, studies project that the severity and frequency of such extreme weather events are projected to increase with climate change.

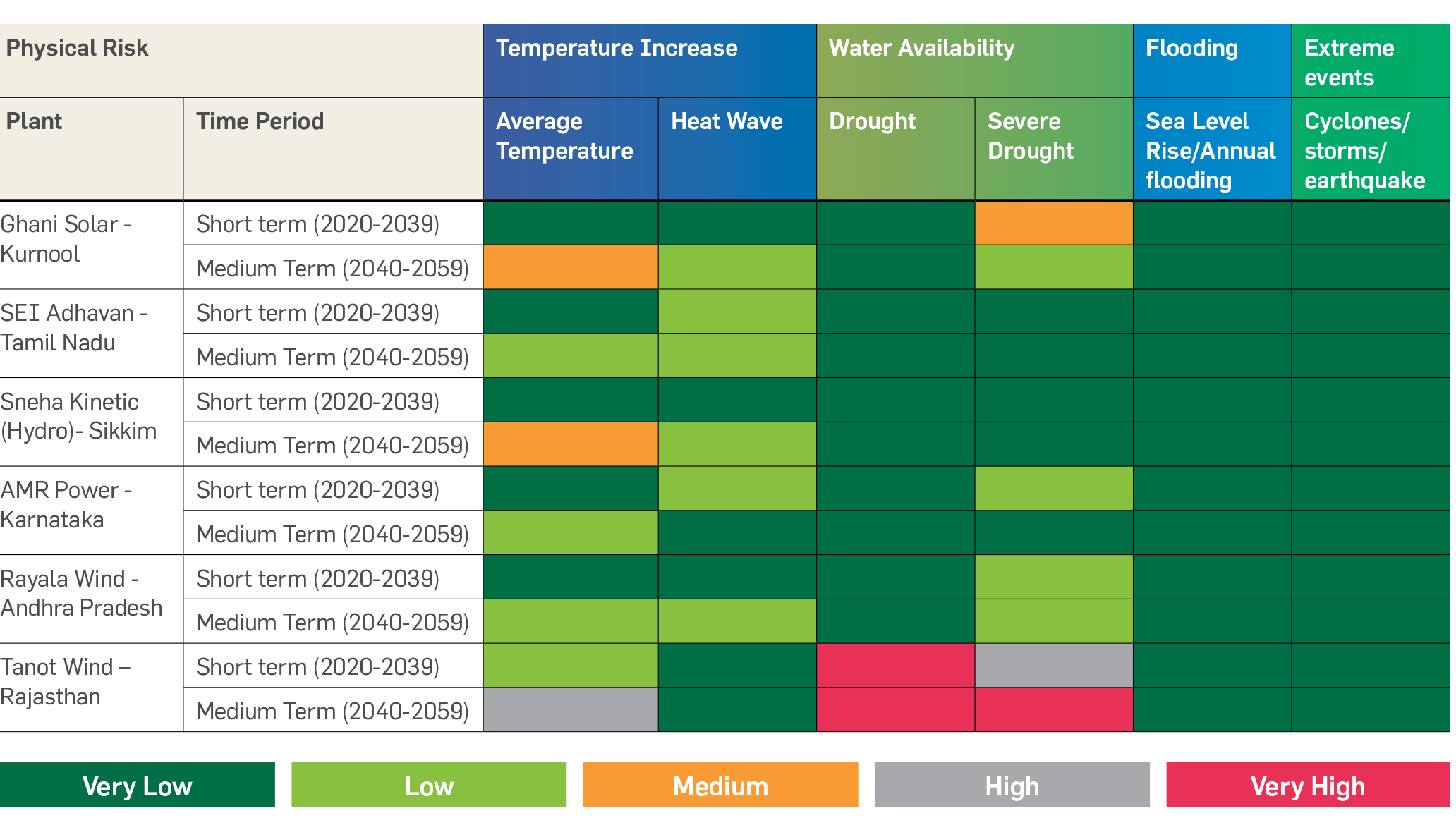

In this context, Greenko has conducted a climate risk assessment for six of its critical operating sites to assess and manage climate risk vulnerability of assets and its productivity. The initial study included two power plants each from the wind, solar, and hydro business verticals. Greenko has studied projected climate change impacts on its operations using IPCC’s RCP 4.5 scenario which is the lowmedium emission pathway (equivalent to 1.7-3.2°C temperature increase). The climate change projections were studied for the period 2020-2039 (Short term) and 2040-2059 (Medium Term).

All projects

The assessment of physical impacts on generation infrastructure does not show significant risk in the short term, except for the wind site in Rajasthan, which presents considerable risk of projected increase in drought probability and severity

The projected drought risk of the wind site continues to increase in the medium term and in addition, the solar site in Kurnool, shows a risk of projected temperature increase of up to 2°C, in the medium term. For both these sites, the appropriate quantification of risk and mitigation measures are also being developed and projected.

Risk

Increase in water stress near few wind and solar farms.

This projected water stress in summer may lead to an increased cost of water and under extreme scenarios, non-availability of water leading to operational disruption.

Mitigation

The organization is carrying out specific plans to manage this situation. On one hand, it has started using automated machine / robotic cleaning of the solar panels, which reduces the water requirement. Also, a detailed dust collection study is being used to schedule the panel cleaning.

On the other hand, the company significantly invests in rainwater harvesting in the regions near to its operations and also as part of its community initiative, to increase the water table in the region.

Opportunities

Development and/or expansion of low emission goods and services

Plans to harness

The government initiatives like REC have led so far, to the purchase of energy from renewable sources. There are a rising number of companies seeking to reduce their carbon footprint and procure 100% of their electricity from renewable sources (i.e. RE100 initiative). The 24x7 RE that Greenko would generate would be the solution for many businesses in India seeking to become RE 100 or meet Science Based Targets.

The Climate Transition risks are the risks that could arise from the process of adjusting to a low carbon economy such as changes in policy, technology and Market.

Changes in public policy to address climate change is an opportunity for Greenko. In its drive for deep Decarbonization, India will have to reform the energy policy ecosystem. To be on the top of these evolving policies, Greenko continuously engages with regulatory processes through proactive participation in discussions and public policy advocacy with both National and Local regulatory bodies viz., MoP, MNRE, MOEFCC, and CERC providing constructive feedback regarding policies and regulations.

Climate change will drive the demand for RE and storage systems. While R&D will advance the possibilities, increased application of innovative methods will bring down prices. The relative costs of alternatives with similar or overlapping functional capabilities is and will be evolving. In such a situation, technology choices of RE and storage face the risk of technology change. Accordingly, Greenko chooses diverse portfolios of technology options after conducting rigorous technology forecasting and assessment.

The transition to a low carbon future presents several market opportunities for Greenko, including a projected increase in demand for renewable electricity, driven primarily by projected increase in temperature and increasing pressure on the energy-intensive sector to move towards a low emission future. Greenko addresses this transition risk by significantly improving its capacity and operation for its transition towards GKO 4.0 which enables delivering firm, reliable, on-demand power.

For more details on Greenko’s Climate Risk Assessment and Management please refer :

Greenko’s Climate Change report

Greenko would build upon stakeholder trust to pursue opportunities and make it possible to generate firm and flexible RE and reinforce energy security and economic stability in India. The group will boost its financial health continuously and strategically by enhancing its appeal to investors by means of its strong credit quality, accessing diverse avenues of funds in the market, continuing to seek sustainable and climate finance through green bond issuance and expanding through organic and inorganic growth.

Further, under the ‘regenerative & circular thinking’, Greenko will strive to achieve holistic wellbeing for overall economic, social, and environmental gain. Clean, and schedulable 24x7 electricity will be the new energy as the demand for oil and gas in India will flatten off much earlier to 2035. Greenko believes that investors across the globe would harness the opportunity to address deep decarbonization and digitalization of the energy sector in India. Greenko would continue to generate and harness ideas even in non-electric use sectors and deliver flexible and firm power while pursuing a healthy capex deployment. In the Climate Risk front, Greenko is in the process of preparing and publishing Taskforce on Climate-related Financial Disclosures (TCFD) in the next financial year.