Financial Capital

Strategic Approach

Greenko is committed to transitioning to a clean energy business and in doing so, has kept its focus on decarbonisation, digitalisation and decentralisation. Greenko harnesses opportunity as the country and the globe is transitioning to new energy that is consistent with the Paris climate goal and ambition. As this requires significant patient capital, Greenko continues to improve its debt capacity and access to capital.

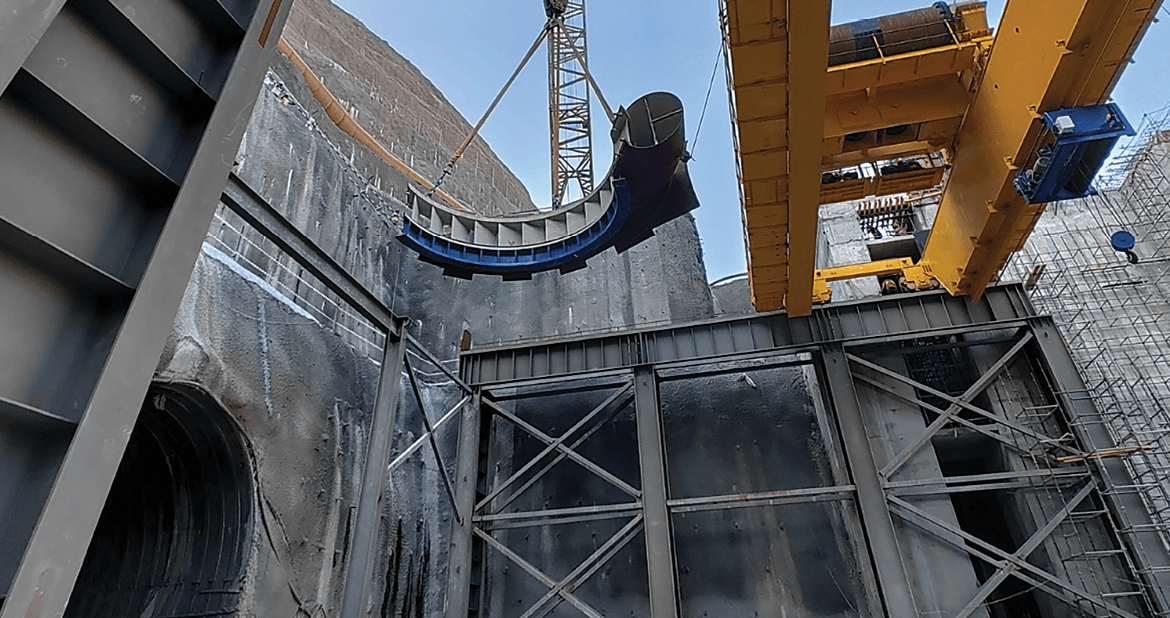

PSP Pinnapuram, Andhra Pradesh

Our Performance

Debt Capacity and Access to Capital

In this financial year, Greenko has committed itself to generate more value for all the stakeholders despite macro-economic headwinds. The Company ensured continuous capital generation and a robust growth by strengthening its financials through various approaches of debt capacity improvement and increased access to capital.

Greenko Group is committed to creating value for all its stakeholders and strives to uphold its credit ratings over the period. In FY 21-22, Greenko has been rated Ba1 by Moody’s Investor Services and BB’ by Fitch Ratings which goes on to prove that Greenko Group has over the years focussed on wealth generation for all its stakeholders. Over the years, Greenko has worked on de-risking its bondholders through a good track record over all the existing bonds as well as the introduction to amortising bonds. Such a rating has led to the Group having a much easier access to a varied source of funds for its capital generation.

Access to Capital KPI

|

KPI |

FY 21-22 |

FY 22-23 (H1) |

|

Green Bond Issuance |

1000 million USD |

750 million USD |

|

Ratings by Moody’s Investor Services |

Ba1 |

Ba1 |

Organic and Inorganic Growth

Greenko, through continued efforts has increased its renewable energy generation by 16.8% in FY 21-22 from 9,745 GWh (2021) to 11,385.6 GWh (2022). This is on account of the full year operations of Orix Wind Portfolio (1,505 MUs) and the commencement of 100 MW Hydro Project in Himachal Pradesh (58 MUs).

Greenko increased its installed capacity by 190 MW in FY 21-22. To achieve this, Greenko acquired 90 MW of renewable energy assets.

Greenko had a fruitful financial year as the Company’s revenue from wind energy projects increased by 32.3% as compared to FY 20-21. On account of the increase in operational capacities in the solar plants, the revenue from solar energy projects increased by 3.7%. At the same time, the Company also achieved a 25.2% increase in earnings from the hydropower projects primarily from the EPPL acquisition leading to an increase in capacity.

After transforming from GKO 2.0 to GKO 3.0, this year as a part of GKO 4.0, Greenko looked to decentralise its operations. As a part of decentralisation, the Company took to dealing directly with the renewable energy customers. In this ever-evolving scenario Greenko has kept up with its growth, both organic and inorganic and has positioned itself as a competitor to look out for.

Intelligent Renewable Energy and Storage Platforms

Currently, four IRESP projects are under development across 4 states of India with a total capacity of 15.82 GW. IRESP are expected to harness the power of solar and wind resources with digitally connected storage infrastructure to provide scheduled and flexible power to the grid.

ZeroC Molecules

As a part of Greenko’s plans to be a Energy and Industrial decarbonisation solution provider, Greenko has entered into :

- A JV with Belgium-based John Cockerill to manufacture electrolysers with annual capacity of 2 GW

- Establishing One 100 KTPA Green Ammonia production plant at Una in Himachal Pradesh

- Establishing One 100 KTPA Green Ammonia production plant at Una in Himachal Pradesh

- Establishing 1 MTPA Green Ammonia production plant in East Coast of India

- Jointly with ONGC, establishing 1 MTPA Green Ammonia production plant in west coast of India

Organic and Inorganic Growth

|

KPI |

End of March 2022 |

|

Capital invested in IRESP |

~ USD 450 million |

Revenue Growth

Greenko Group due to its sustainable practices and balanced financial condition has been able to place itself in the top 3 clean energy transmission companies in India. The Group has heterogenous sources of revenue – diversified renewable generation technologies and diversified PPA structures.

Diversified source and renewable technologies

Diversified PPA Structure

The Group capitalises on the different power generation sources it has tapped on and which ensures that there is secure and seamless power generation and distribution throughout the year through the various seasons. By aligning itself with solar, wind and hydro power sources of energy generation, Greenko Group has been able to mitigate the risk arising from the non-firm nature of renewable energy sources. Greenko Group understands that long-term PPAs with federal and state agencies are the leading power sale options for renewable developers in India.

Revenue Growth

|

KPI |

FY 21-22 |

FY 22-23 (H1) |

|

Revenue Collection Efficiency |

76% |

114% |

Diversified Revenue Sources

|

KPI |

FY 21-22 |

FY 22-23 (H1) |

|

Revenue received through Generation Based Incentive |

28.5 million USD |

24.02 million USD |

|

Revenue received from power trading through IEX |

INR 221.4 Cr |

INR 470.26 Cr |

|

KPI (all units in MU) |

FY 19-20 |

FY 20-21 |

FY 21-22 |

FY 22-23 (H1) |

|

Saleable electricity (Excluding Import Energy and line losses) |

9,969 |

8,862.67 |

10,725.91 |

10,658.19 |

|

Sale of electricity to utilities (PPA / Feed-in tariff) |

7,879.18 |

7,873.50 |

9,633.83 |

9,263.64 |

|

Sale of electricity through Wheeling and banking (direct sale to consumers) |

620.01 |

637.34 |

610.15 |

602.40 |

|

Sale of electricity through exchange |

403.54 |

350.84 |

481.93 |

792.14 |

In 2021-22, the Company sold 5.68% of the power generated through open-access space (B2B segment).

|

KPI (all amounts in million USD) |

FY 19-20 |

FY 20-21 |

FY 21-22 |

FY 22-23 (H1) |

|

Profit before taxation |

64.8 |

-154.96 |

-15.92 |

194.49 |

|

Profit for the year |

21.5 |

-208.2 |

-75.96 |

152.28 |

|

Earnings before interest, taxes, depreciation and amortisation (EBITDA) |

562.42 |

430.74 |

570.24 |

383.48 |

|

Total Revenue |

660.9 |

594.9 |

723.05 |

461.5 |

|

Revenue from Wind energy projects |

379.4 |

316.1 |

418.1 |

270.89 |

|

Revenue from Solar energy projects |

212.3 |

201.6 |

209.08 |

99.69 |

|

Revenue from Hydro energy projects |

67.5 |

76.6 |

95.9 |

90.92 |

|

Other operating income |

1.6 |

2.5 |

3.75 |

0.6 |

|

GBI revenue |

25.7 |

21.4 |

28.5 |

24.02 |

|

REC certificates |

5.1 |

0.1 |

9.2 |

1.72 |

|

Employee benefits expense |

28.6 |

61.2 |

33.28 |

15.68 |

|

Cost of material and power generation expenses |

56.2 |

57 |

72 |

34.86 |

|

Other operating expenses |

24.3 |

38.6 |

35.36 |

21.44 |

We have witnessed higher losses in FY 20-21 which is on account of abnormally low wind season across the industry which contributed to revenue loss. Further, there were some non-cash expenses in FY 20-21 which reduced the PAT. With the transition of focus from standalone renewables to pumped hydro projects, Greenko Group is set to reduce the resource risk on an overall portfolio basis in the coming year.

Seamless Fund Flow to the Targeted Objective

Greenko has effectively raised debt and equity financing for its projects. Both debt and equity financing clearly lay out the use of proceeds for these are earmarked to the projects. Thus, the flow of funds once decided towards targeted uses is seamless.

Accessing Sustainable Financing through Green Bonds

Global energy infrastructure needs and the increasingly pressing challenges and risks associated with climate change present the world with an unprecedented investment opportunity related to the transition to a low-carbon climate resilient economy. Green bond signifies the commitment to exclusively use the funds raised to finance or “re-finance” green projects. It is a fixed-income financial instrument for raising capital from investors through the debt capital market.

Greenko Group ensures complete transparency and accountability of the proceeds of the green bonds.

In November 2017, Greenko raised₹ 30 billion

through the sale of onshore rupee denominated bonds which will mature in 2027.

In July 2019, Greenko Energy Holdings raisedUSD 950 million

through green bonds. The issue was oversubscribed by over three times and was one of the largest green bond issues by a renewable energy Company.

In March 2020, Greenko has raisedUSD 940 million

through the green bond issue priced at

3.85%

In March 2021, Japanese financial services Company

Orix Corporation acquired a 21.8% stake in Greenko Energy Holdings in exchange of

USD 961 million

In March 2022, Greenko has successfully raisedUSD 750 million through green offshore bonds priced at

5.5% with maturity after 3 years.

Sustainable Financial Partnerships

Greenko Group understands the importance of the strategic sustainable partnerships hold in the long term for wealth generation for the Company. In the last financial year Greenko Group has been committed towards the same by entering in to two partnerships to augment its hydro energy storage pipeline. ArcelorMittal and the Greenko Group entered into a strategic partnership to construct a round-the-clock 975 MW nominal solar and wind project. The project entails an investment of USD 600 million and is expected to be commissioned by mid-2024. Greenko’s hydro pumped storage project will be utilised to overcome the intermittent nature of wind and solar power generation. Greenko is also responsible for designing, constructing and operating the renewable energy facilities, which will be based in Andhra Pradesh.

The Group also signed an agreement with John Cockerill, a Belgian manufacturer of alkaline electrolysers, in March 2022, to jointly develop market initiatives for green hydrogen electrolysers in India.

In March 2021, Japanese financial services Company Orix Corporation acquired a 21.8% stake in Greenko Energy Holdings in exchange of USD 961 million. As per the agreement, Orix also added 873 MW of its wind energy portfolio in India to Greenko’s portfolio in exchange for the shares.

“As a major emitter of CO2 and indispensability of its products to global energy transition; the chemicals sector is due for a move to a low-carbon, circular economy with its own commitments to decarbonisation. The sector has started to warm up to decarbonisation need largely due to investors, consumer, government, and regulatory pressure. As part of the European Green Deal, the European chemical sector has committed to carbon neutrality by 2050 to help achieve the climate resolve. Major chemical companies like Dupont, Dow Chemical and others have announced significant initiatives focussed on sustainability.

Partially, chemical industry’s long-term emission targets can theoretically be achieved by maximising energy and resource efficiency; however, remaining targets relate to Scope 2 and Scope 3 emissions that occur in the upstream and downstream value chain. Greenko, with its competitively priced firm & dispatchable carbon free energy and zero carbon molecules, is ideally positioned to decarbonise the chemical sectors at all levels of value chain. Several chemicals, with round-the-clock power as significant cost of production, can be Greenko’s primary focus to dominate the low carbon chemicals market in India and globally. Examples of such chemicals include Caustic Soda, Methanol, Ethanol, Aviation Fuel and Ammonia Sulphate.”

Vinay Rungta Senior VP, Strategy and M&A

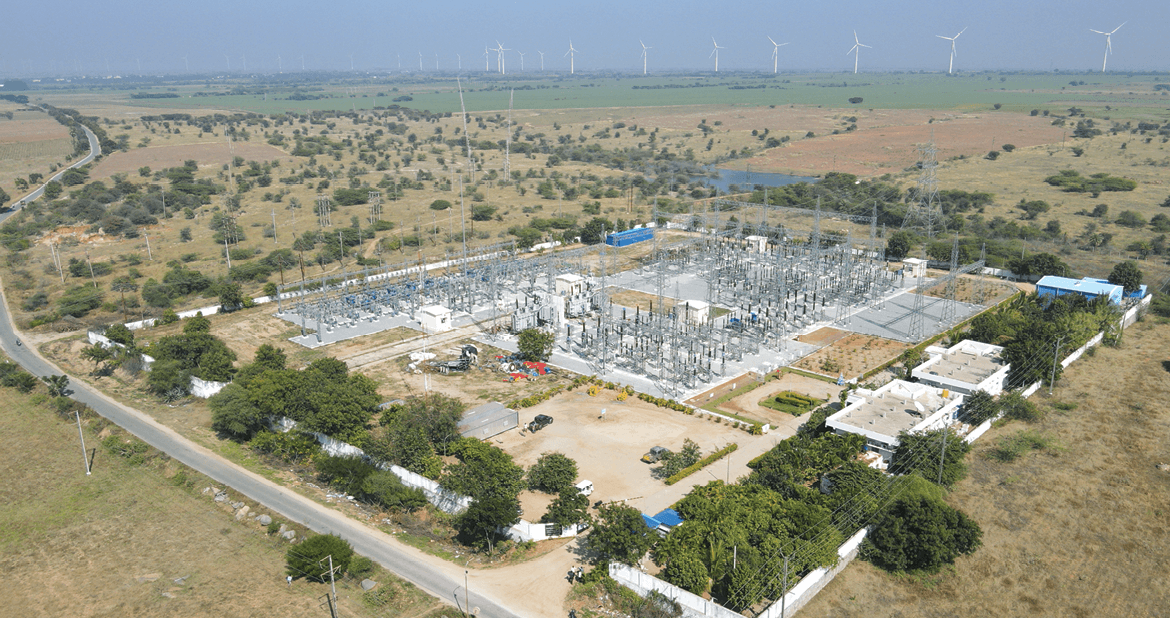

Greenko Rayala Wind Power Pvt Ltd, Andhra Pradesh

EU Taxonomy Conformance

The EU Taxonomy Regulation provides a systematic classification system based on objective criteria for identifying environmentally sustainable economic activities. In addition to promoting sustainable investments, the EU Taxonomy Regulation also helps companies prepare for the Net Zero transition and supporting investor security and transparency.

The percentage of a Company’s revenue, operational costs, and capital expenditures that can significantly contribute to at least one of the EU’s environmental goals must be disclosed in accordance with the EU taxonomy. The EU taxonomy requires the disclosure of financial data related to the economic activities included in delegated acts on climate change adaptation and mitigation.

Greenko followed the 5-step process as below to arrive at financial metrics that demonstrate Greenko’s economic activities in climate change adaptation and mitigation:

Implementation process

![]() Identifying the eligible activity from the list defined in delegated acts mainly accounting to the European NACE

nomenclature.

Identifying the eligible activity from the list defined in delegated acts mainly accounting to the European NACE

nomenclature.

![]() Compliance with technical criteria - analysis of criteria for substantial contribution to at least one of the environmental

objectives.

Compliance with technical criteria - analysis of criteria for substantial contribution to at least one of the environmental

objectives.

![]() Checking whether the identified economic activity has no significant harm to any other objectives.

Checking whether the identified economic activity has no significant harm to any other objectives.

![]() Meet minimum social safeguards (Human rights and principles, fundamental rights at work, and labour rights).

Meet minimum social safeguards (Human rights and principles, fundamental rights at work, and labour rights).

![]() Calculation of KPI’s (Turnover, Capex, and Opex).

Calculation of KPI’s (Turnover, Capex, and Opex).

EU Taxonomy Financial Metrics

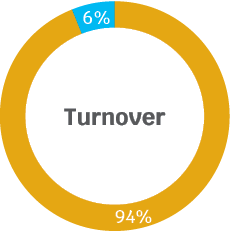

Turnover

- Eligible Turnover - 94%

- Non-eligible turnover - 6%

- Eligible turnover was mainly derived from electricity generation from hydro, wind, and solar power

- Non-eligible turnover primarily concerned with the net sale of power to end-user (Activity not covered by EU taxonomy)

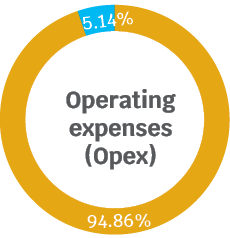

Operating expenses (Opex)

- Eligible Opex - 94.86%

- Non-eligible - 5.14%

- Opex is mainly derived from operation, maintenance of non-current assets, repair costs and any other direct expenditures relating to the day-to-day servicing of assets of hydro, wind, and solar power plants and amount spent on R & D

- Non-eligible Opex primarily concerned with other activities like logistics, information technology and telecommunication equipment, consumer electrical and electronics etc.

Capital expenditures (Capex)

- Eligible Capex - 98.4%

- Non-eligible Opex - 1.6%

- The investments reported in accordance with IAS 16 and IAS 38

- Capex mainly derived from the investments made on the generation of electricity from wind, hydro and solar power

- Non-eligible Capex primarily concerned with the investments made on other activities like logistics, information technology and telecommunication equipment, consumer electrical and electronics etc

(IAS 16: applies to the accounting of property, plant and equipment, IAS 38: Intangible assets)

Eligible

Eligible  Non-eligible

Non-eligible

Integrated Report 2022

Integrated Report 2022

Previous Page

Previous Page Next Page

Next Page