External Operating Environment

Energy system and its transition is complex and riddled with multiple trade-offs. This is evidenced by recent geopolitical developments and macroeconomic turbulence, calling for a balanced approach that delivers on the imperatives of sustainability, affordability, security, and access transition. The pandemic, the steep economic rebound, and the war in Ukraine have successively disrupted energy supply and demand, causing significant consequences for people, companies, and economies around the world. This demonstrated that the energy transition is not immune to the impacts of major environmental, economic, and geopolitical events; the trade-offs exist and require a balanced approach. Such an approach is required to establish a resilient energy transition capable of achieving long-term climate ambitions, regardless of the challenges that might impact the journey.

As the energy system reconfigures to a low-carbon future, temporary supply-demand imbalances can happen differently in various geographies. The diversification of the energy mix with fossil and non-fossil sources can help strengthen energy security. Countries can engage in dual diversification: diversifying their fuel import partners in the short term and their energy mix in the long term. Current energy security constraints provide an opportunity to accelerate the transition through increased clean energy interventions and transforming energy demand pattern. Renewable energy capacity installations set a record in 2021 with 290 gigawatts (GW) of new wind and solar capacity added worldwide, and solar cumulative capacity crossing 1 TW in May 2022, still falling short of 2030 targets and Net Zero ambition.

Technology, financing, and policies are engaging the most attention of companies’ and governments to decarbonise the supply side. Demand-side initiatives, such as the First Movers Coalition, designed to create demand for technologies and measures for Net Zero are being operationalised. These must be rapidly replicated to incentivise investments in low-emission technologies and production assets.

Further to accelerating the demand for Net Zero technologies and production assets, multistakeholder collaborations between suppliers and customers (e.g. zero/low-emission product offtake agreements, circular decarbonisation projects, etc.), between industry and cross-industry peers (e.g. carbon capture infrastructure, collaborative platforms for decarbonisation, etc.), and between the wider industrial ecosystem of stakeholders (e.g. collaborative research for low-carbon technologies etc.) will be critical to overcome decarbonisation choke points and accelerate the industrial transformation towards Net Zero.

This decade is the window of opportunity to prevent the worst consequences of climate change. In the face of present energy crisis, it is critically important to speed up action on the path to Net Zero emissions while addressing energy security needs.

The context of India and some developing countries is different from that of many developed nations. India is blessed with resources of wind, solar and water combined with vast coastline and complex terrain that supports generation and storage of renewable energy. “One Nation, One Grid” further strengthens the above advantage. It offers an opportunity to substitute fossils in new capacity of electricity generation and substitute oil & gas - which is being presently imported, with electric and nature-based fuels and chemicals. This is the plan that Prime Minister has outlined in his Independence Day speech as Energy Independence by 2047.

India at the Cusp

Energy is central to achieving India’s development ambitions such as electrifying each home, developing infrastructure driven by urbanisation, rising incomes and industrial activity. Transition to electrified mobility and industrial applications would add to the demand of electricity. India’s growth in demand for energy would be 30% to global energy demand growth by 2035. As per India Brand Equity Foundation (IBEF), the economic development in India has stimulated the demand for electricity and the total consumption is expected to reach 15,280 TWh in 2040, from 4,926 TWh in 2012. Thus, India has to focus on decarbonising the “growth energy” unlike the priority of decarbonisation in developed World to phase out the fossil-based power generation.

India is becoming a major global energy player with a strategic interest in well-functioning energy markets. All four major energy-consuming sectors – industry, household, transport, and agriculture are expected to see a rise in demand. Energy consumption in the country is forecast to grow at around 4.5% annually to 2035 (up from 3.5% from 2000–2017).

Similarly, the nature of Indian power demand is also evolving. India’s uptake of renewables is driven by the advent of new and cheaper energy technologies and the need to reduce air pollution which results in more than one million premature deaths in India each year. The electricity constitutes 15% of final energy consumption in India and the demand is set to keep growing at 5.8% per annum. Also, the per capita electricity consumption in India is 1,010 kilowatt hours (kWh), against a world average of 3,200 kWh.

Further, India is the third-largest producer and consumer of electricity in the world and has an installed power capacity of 407.79 GW as of September 30, 2022. The installed renewable energy capacity (including hydro) stood at 164.93 GW, representing 40.04% of the overall installed power capacity. Solar energy is estimated to contribute 60.81 GW, followed by 41.66 GW from wind power, 10.68 GW from biomass, 4.89 GW from small hydropower, and 46.85 GW from hydropower. The non-hydro renewable energy capacity addition stood at 4.2 GW for the first three months of FY23 against 2.6 GW for the first three months of FY22.

Further, by 2029-30, CEA estimates that the share of renewable energy generation would increase from 18% to 44%, while that of thermal energy is expected to reduce from 78% to 52%.

Opportunity for India

The scale of India’s demand and its stage of development together present an opportunity for India to emerge as a global leader in offering decarbonisation solutions. This opportunity could position India to achieve durable economic growth and global competitiveness over the coming decade.

The country has set an ambitious target to achieve a capacity of 500 GW of non-fossil based power generation capacity by 2030. To meet this target and further to tackle the annual coal demand supply mismatch, the Ministry of Power has identified 81 thermal units which will replace coal with renewable energy generation by 2026. Also, India is blessed with a variety of renewable energy sources, like biomass, the solar, wind, geothermal and hydropower which are local resources available in abundance making it cost-effective and ensure energy security. Utilising the available natural resources coupled with appropriate storage solutions can generate cost-effective demand - following RE.

Further, India can also produce Zero Carbon Fuels and Chemicals using renewable energy. India‘s target is to produce 5 MT of green hydrogen by 2030. India’s electrolyser manufacturing capacity is projected to reach 8 GW per year by 2025. The cumulative value of the green hydrogen market in India could reach USD 8 bn by 2030 and India will require at least 50 gigawatts (GW) of electrolysers or more to ramp up hydrogen production, proving India has a great opportunity in the sector too. Pursuing this opportunity will reduce reliance on imported oil, improved air quality, and increased renewable energy supply.

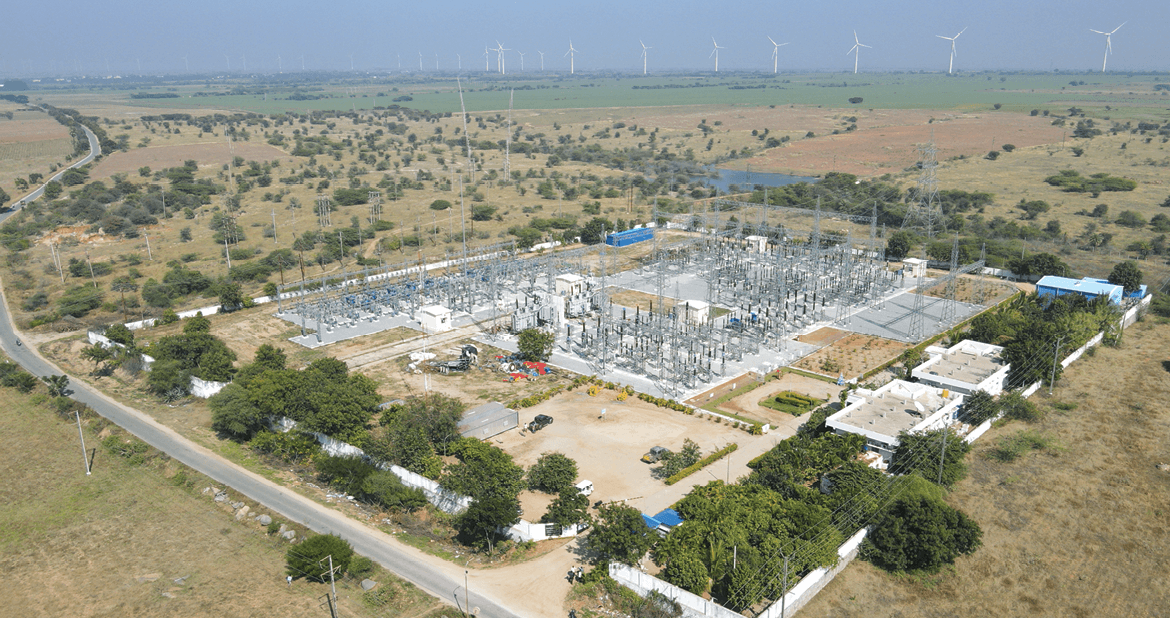

Greenko Rayala Wind Power Pvt Ltd, Andhra Pradesh

RE Technology Progress and Price Parity

The solar power sector in India is experiencing significant growth in the past and in recent years the new solar installations have slowed as the government introduced basic customs duty on the import of solar modules and cells. Currently, about 70% of India’s solar capacity comes from imported solar cells, which are locally assembled into panels and then used for grid or rooftop installations. The new duty may encourage domestic manufacturing in the long run, but it has significantly increased the cost pressure on under-implementation solar projects for now.

Presently, solar accounts for less than 4% of India’s electricity generation, and coal is close to 70%. By 2040, they converge in the low 30%, and this electrifying turnover is attributed to policy initiatives and targets set by the Government. The Indian electricity sector is at the cusp and there is huge potential not only for large PV plants but, also for small distributed renewable energy sources like solar rooftops, solar pumps, cold storages etc. Solar energy is now the lowest-cost source of new energy in India. Spain, India, and the Middle East will continue to be the markets with the lowest solar Levelised Cost of Electricity (LCOE). Meanwhile, average module efficiency continues to increase, surpassing 22.5% in PERC monocrystalline cell commercial production. Solar energy has the potential to meet the energy needs of low incomed residential groups and thereby, can also help in achieving 100% electrification of households. Further, the Performance Linked Incentive scheme by Government of India has triggered the domestic manufacturing of solar panels and this could even lead to further lowering of price.

Power System Flexibility as the share of RE increases

There is a paradigm change in our power system operations. In the past, fully controllable power generation followed non-controllable load demand. With renewable energy, generation is no longer fully controllable due to weather fluctuations leading to uncertainty in generation output. The variability of RE resources requires the adoption of grid-scale energy storage technologies to complement these sources. Power system flexibility is defined as the ability of a power system to manage the variability and uncertainty of demand and supply reliably and cost-effectively across all relevant timescales. The deployment of variable renewable energy sources is accompanied by challenges such as increase in system requirements for balancing supply and demand. To effectively aid the transition from fossil fuels and ultimately to Net Zero levels, it becomes necessary to identify and exploit various flexible system integration sources in all stages viz., Generation, Distribution, Storage.

International experience suggests that a diverse mix of flexibility investments is needed for the successful system integration of wind and solar PV. Operational Complexity rises as the share of variable renewables rises. Hydro Power and Pumped Storage systems are flexible renewable energy sources in India for a long period. The need for flexible energy system was realised during the pandemic and hence, Central Electricity Regulatory Commission (CERC) has come up with the regulation to operate coal-fired power plants with minimum generation levels at 55%. This has proved effective in increasing the capability of coal-fired plants to accommodate Variable Renewable Energy (VRE). Supply-side Flexibility System integration further includes grid reinforcement and planning to effectively accommodate VRE energy generation.

RE Electrification

For energy system to undergo global transformation, to transition towards decarbonisation, all the activities such as buildings, transport and industries must be electrified as much as possible. Once electrified, the source of electricity generation should be renewable energy, making it RE-Electrifying.

Electrifying final consumption and then using electricity from renewables is an effective way to bring about the energy transition. However, RE-electrification faces operational challenges by looking beyond the generation side of the power system and tapping all available sources of flexibility. One such challenge is particularly the case for flexibility of demand over a wide range of time scales.

Therefore, to deliver this new system in a cost-effective manner, RE-electrification requires smart devices and other information technologies that offer much more flexibility and control over demand and the delivery and use of renewable electricity. The integration of smart approaches in combination with digitalisation is key to reduce the risk of rising peak loads, to expand opportunities for renewable power utilisation, and to avoid the need for massive investment in building new grid infrastructure. Smart electrification with renewables thus creates a virtuous cycle, where electrification drives new uses and markets for renewables, which then accelerates the switch to electricity for end uses, creating more flexibility and thus driving further renewables growth and technological innovation. Growth and innovation also reduce costs and create additional investment and business opportunities.

Decarbonisation of Energy and Industry

India is one of the largest energy producers and consumers in the world. Energy sector accounts for 73% of GHG emissions which is the result of cumulative energy usage in iron and steel industries, petro-chemical industries, transport sectors, residential and commercial buildings. Some of these sectors such as transport, residential and commercial buildings can be RE-electrified directly.

However, for the sectors dependent on natural gas, petrol, diesel, carbon monoxide etc., for a chemical reaction, the necessary chemistry may be performed by alternate green chemical e.g., in steel industry the reduction agent Natural gas can be replaced by Green Hydrogen; or the same chemical produced with Zero emissions e.g., Ammonia for fertilizers. In addition, the ‘hard-to-abate’ industrial sectors such as shipping, aviation, mining, and heavy industry, should also be RE Electrified and use green fuels such as E-methanol for shipping.

Green hydrogen and its derivative molecules are expected to evolve as an alternative fuel or chemical replacing fossils or fossils’ derived chemicals, especially in energy and GHG intensive processes. The exponential growth in the electrolysis project pipeline in 2020 and the unprecedented interest around hydrogen as a decarbonisation tool have been driven by a combination of falling costs of RE and Electrolysers; and policy support.

Variable Renewable Energy (VRE)

As this share of variable renewable generation continues to increase, India’s power system will have to evolve and modernise to respond to grid stability challenges. There is a need for an accelerated deployment of assets such as utility-scale storage in order to store power when it is available in abundance and provide firm power later, during the evening peak hours or at other times when generation is low, but demand is high. This is where, Energy Storage Systems will play a crucial role in increasing the system flexibility to not only accommodate the demand requirements but for effective grid management as well.

Energy Storage Market

The energy storage market in India witnessed a demand of 23 GWh in 2018 with 56% of the battery demand coming from the power backup inverter segment. Moreover, the report titled ‘Advanced Chemistry Cell Battery Reuse and Recycling Market in India’ anticipates that the total cumulative potential for battery storage in India will be 600 GWh by 2030 considering a base case scenario and with segments like EVs and consumer electronics projected to be major demand drivers for the adoption of battery storage in India. The report further suggests that by 2030, the demand for batteries is expected to grow four-fold to reach an annual rate of 3,100 GWh, it said, adding this shows a growth of 16 per cent CAGR through 2020-30. Besides, the NEP draft report 2022 also predicts that India will need a Battery Energy Storage System (BESS) of 51 gigawatts of storage capacity by 2031-32.

The electricity sector in India has undergone rapid transformation in recent decades. At COP26, India announced the highly ambitious goal of decarbonising energy to 50% and achieving 500 GW of fossil fuel free generating capacity by 2030. As per the draft National Electricity Plan of CEA, the non-fossil fuel-based capacity is likely to increase to 592 GW in 2031-32, which includes 467.4 GW of variable renewable energy (VRE) based installed capacity.

Achieving the above objectives entails enabling policy and regulatory framework for integrating requisite quantum of renewable energy in the grid. One of the critical enablers for the integration of very high share of renewables will be energy storage. As per the generation planning studies, Pumped Hydro Storage (PSP) capacity of about 6.81 GW with 46.65 GWh of storage is required by year 2026-27 to fulfil the storage requirement of the Grid. The storage capacity requirement increases to 70.38 GW (18.82 GW PSP and 51.56 GW BESS) with storage of 392.78 GWh (135 GWh from PSP and 257.78 GWh from BESS) by the year 2031-32. Recognising the above requirement, Ministry of Power has outlined trajectory of Energy Storage Obligation. The Energy Storage Obligation (storage on energy basis) varies from 1% in FY 2023-24 to 4% in FY 2029-30.

Within the various storage technologies, PSP has multiple advantages, particularly in the context of grid scale, long duration applications. Globally, there is a revival in PSP with significant capacity under construction. In India also, multiple PSP plants are under construction.

Greenko Sumez Hydro Energies Pvt. Ltd., Himachal Pradesh

Special Measures to Promote Growth of RE

Firm Energy / Round-The-Clock (RTC) Power

To overcome the issues of intermittency and low-capacity utilisation of transmission infrastructure, the mechanism of ‘bundling’ has been brought out by Government of India. To ensure uninterrupted firm power round-the-clock, RE is bundled with power from other sources or combined storage. Such bundled power is supplied to the distribution Company (DISCOM) thereby obviating the need for DISCOMs to balance power. With the aim of promoting RE power and to provide Round-The-Clock (RTC) power to the DISCOMs from renewable energy sources, Ministry of Power has issued RTC power Guidelines in 2020.

A steady increase in the demand for Round-the-clock (RTC) power is witnessed. Some of the utilities in India have already gone through the transparent procurement process and have contracted for stand-alone storage capacities. The key objective is to serve the round-the-clock demand requirement of discoms through RE sources. As the demand for Energy Storage Contracts increases, varied contracts such as contracting of ‘storage capacity’ on a ‘standalone basis’, peak power, dispatchable RE contracts are emerging.

Additionally, there is good traction on the private sector procurement as well. Many of the large Commercial and Industrial (C & I) consumers with climate mitigation commitments have set a target for procuring RTC power from RE sources for meeting its demand requirements. This, along with policy support, will further open the market for Energy Storage.

Renewable Purchase Obligations (RPO)

Uniform Renewable Purchase Obligations (RPO) have been introduced wherein all electricity distribution licensees have to consume a specified minimum quantity of their total requirements from Renewable Energy Sources.

As per the Ministry of Power (MoP) order dated 22nd July 2022, the RPO is as per the table below:

Hydro Power Obligations (HPO)

Hydro Policy, 2019 was notified by Govt. of India on 8th March, 2019, where in Hydropower Purchase Obligation (HPO) will be met only by energy produced from large hydro projects (LHP), including pumped hydro, commissioned after 8th March, 2019, and up to 31st March, 2030.

Power House under construction, Pinnapuram PSP, Andhra Pradesh

Circular Economy

Circular Economy practices can also augment climate change mitigation by increasing the life cycle of materials and thereby reducing the corresponding GHG emissions associated with the manufacturing process, transportation of raw materials. Material efficiency plays a significant role in promoting circular economic business models. Take-Make-Waste linear models when replaced with circular models can have impactful results in decarbonising the systems. Life cycle emissions of solar and wind systems will also be drastically reduced since a major portion of emissions is from the fabrication of systems. The barriers like government regulations, technological feasibility, consumer behaviour, and expectations should be handled efficaciously to establish synergies between decarbonisation and circular business models.

The three circular approaches

Up to 45% of emissions associated with industry, agriculture, and land use that the energy transition can’t address, can be tackled with circular economic approaches.

For example, in buildings and construction, by eliminating waste, sharing buildings more, and by reusing and recycling construction materials, we can reduce the emissions from construction materials by 38% by 2050.

Likewise, in agriculture, shifting to regenerative production, practices, eliminating food waste, and using better and upcycled ingredients in our food products and menus, we could halve food system emissions by 2050.

Carbon Capture, Usage and Storage (CCUS)

CCUS that can capture and make effective use of the high concentrations of CO₂ emitted by industrial activities can also play a key role in decarbonisation. CCUS technologies offer significant strategic value in the transition to Net Zero:

- CCUS can be retrofitted to existing power and industrial plants

- CCUS can tackle emissions in sectors where other technology options are limited, such as in the production of cement, iron and steel or chemicals, and to produce synthetic fuels for long-distance transport (notably aviation)

- CCUS can remove CO2 from the atmosphere by combining it with bioenergy or direct air capture to balance emissions that are unavoidable or technically difficult to abate

There are around 35 commercial facilities applying CCUS to industrial processes, fuel transformation and power generation, capturing 45 Mt CO2. CCUS deployment has grown substantially in recent years, with around 300 projects in various stages of development across the CCUS value chain and is expected to capture over 220 Mt CO2 per year. Nevertheless, even at such level, CCUS deployment would remain substantially below what is required in the Net Zero Scenario.

The key to a successful CCUS policy for India is a framework that supports the creation of sustainable and viable markets for CCUS project outcome. The framework must consider the fact that the private sector is unlikely to invest in CCUS unless there are sufficient incentives to do so (or conversely penalties from inaction), or unless it can benefit from the sale of CO2 or gain credits for emissions avoided under carbon pricing regimes. Direct capital grants, tax credits, carbon pricing schemes, operational subsidies, regulatory requirements, and public procurement preference for low-carbon products are some of the policy measures required for CCUS to become a reality in India.

Nature Based Solutions (NbS)

NbS mitigate climate change by capturing CO2 from the air and sequestering it in plants, soils, and sediments. Some of the examples are forests to regrow, restoring coastal wetlands, and switching to restorative agricultural practices, such as cover crop rotation, that support healthy soils.

NbS also play a key role in climate change adaptation and building resilience in landscapes and communities. Several nature-based solutions are being used by the World Bank to help manage disaster risk and reduce the incidence and impact of flooding, mudslides, and other disasters. They are a cost-effective way of addressing climate change while also addressing biodiversity and land degradation and address several problems at once.

Based on the existing evidence, taking account of associated uncertainties and the time needed to deploy safeguards, UNEP estimates that by 2030, nature based solutions implemented across all ecosystems can deliver emission reductions and removals of at least 5 GtCO2e per year, of a maximum estimate of 11.7 GtCO2e per year. By 2050, this rises to at least 10 GtCO2e per year, of a maximum estimate of 18 GtCO2e per year. This is a significant proportion of the total mitigation needed.

“At this momentous time, we are embracing a tremendous transformation in the energy landscape, which is spurring on remarkable changes to our markets and organisations. We are seizing the previously untapped potential of the energy sector, and creating long-term worth with innovative energy services. It’s essential that we now assess our business strategy from a sustainability perspective to address the impacts of climate change. In order to turn ‘Green Electrons’ into ‘Zero Carbon molecules’, we require abundant green electricity, as well as electricity at a reduced cost – and our analysis and predictions show us that this is achievable.”

Integrated Report 2022

Integrated Report 2022

Previous Page

Previous Page Next Page

Next Page